Automotive stocks: The effect of tariffs on shares of popular automakers

According to Wedbush Securities Inc. analyst Daniel Ives, Trump's automobile tariffs "will cause pure chaos to the global auto industry" and increase the average price of cars sold in the U.S. by as much as $10,000.

And that's what we've seen so far when looking at share prices.

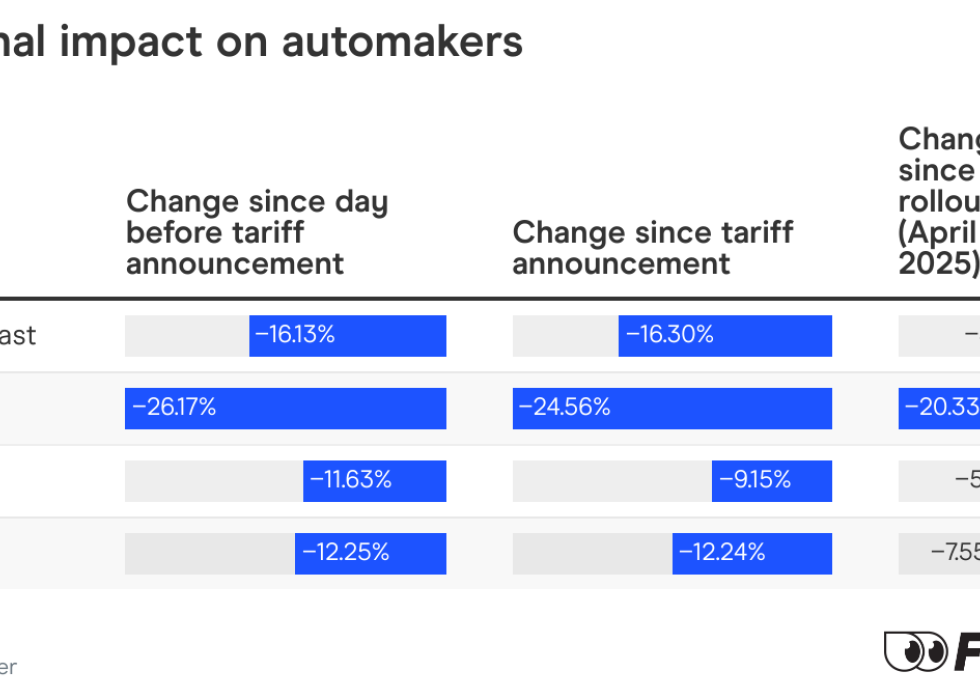

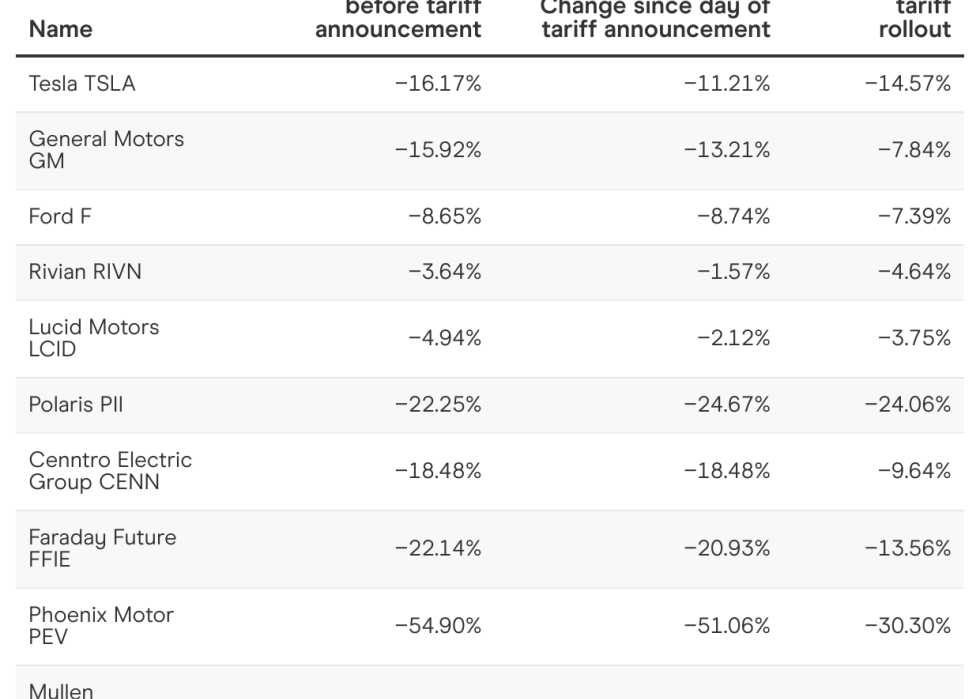

According to Finder's data, automaker stocks across the board responded negatively to President Trump's 25% tariff announcement, with U.S. carmaker stocks seeing the largest decline on average.

It's been a turbulent time for many U.S. automakers, including Lucid Group stock (Lucid Motors), General Motors (GM) and Tesla (TSLA).

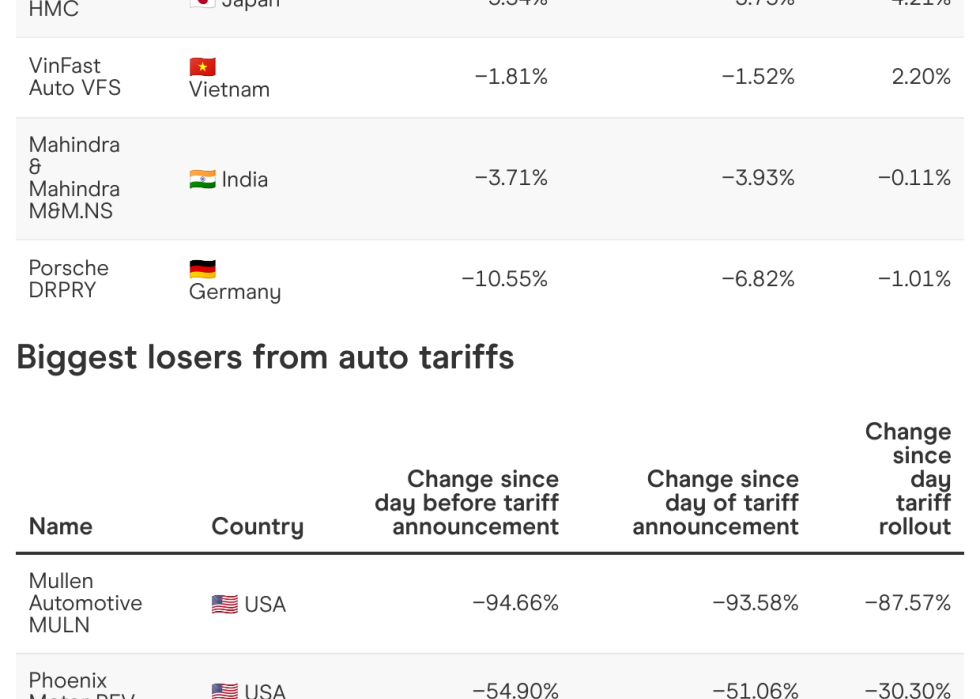

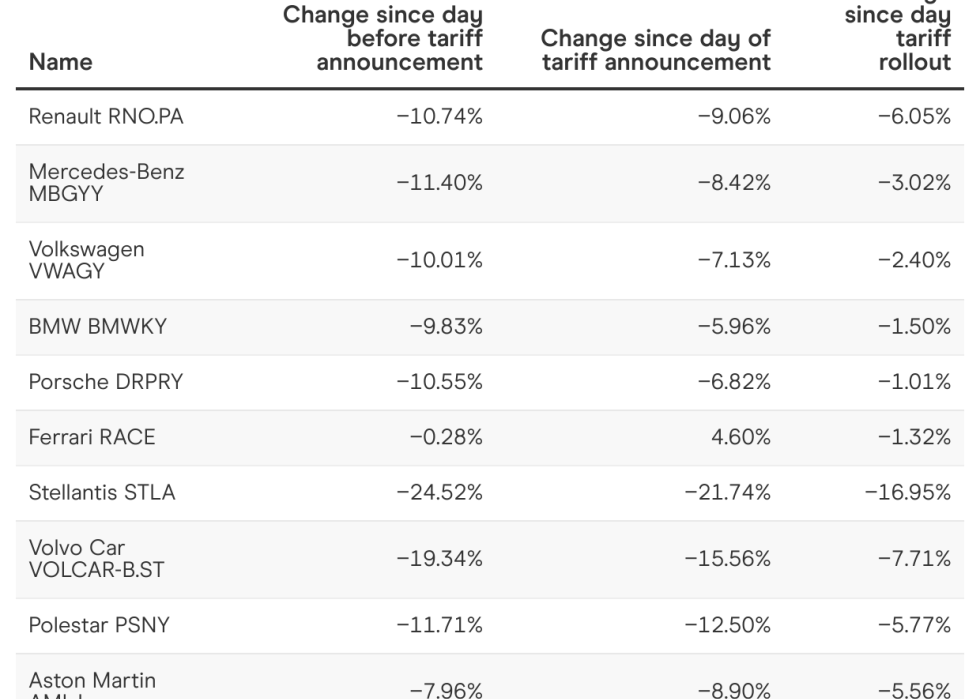

There have been no winners in the European auto-making market, with Ferrari (RACE), Polestar (PSNY) and Porsche (DRPRY) all seeing major declines since the tariff rollout.

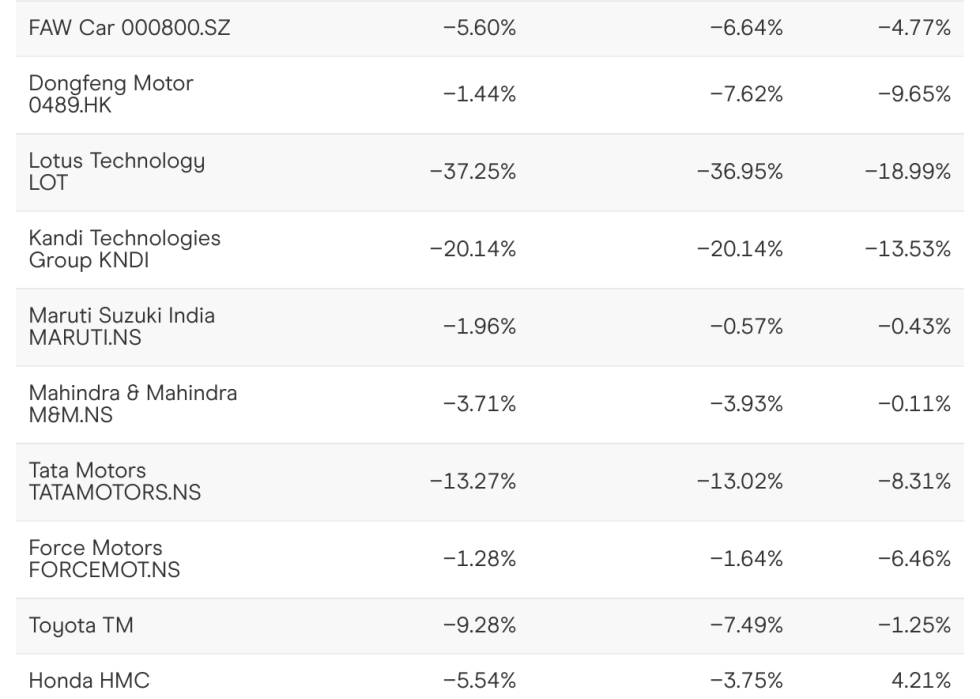

Asian auto makers have also seen major dips since the tariffs were implemented.

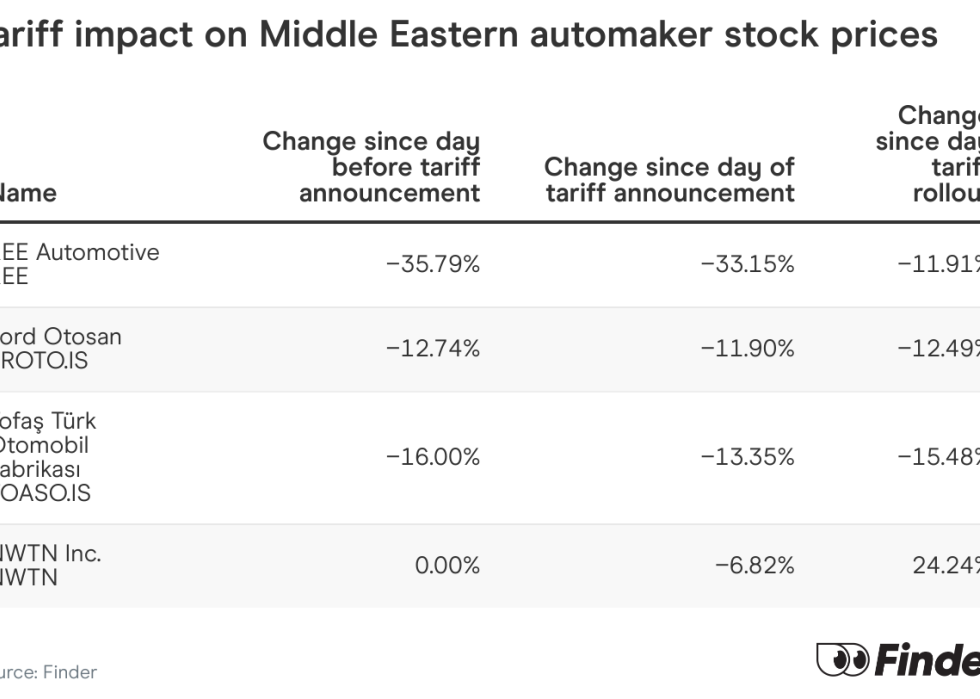

Middle Eastern automakers have seen many ups and downs (mostly downs) since the tariff announcement.

Tariffs are taxes that governments impose on goods entering or leaving a country, and they're typically used to raise revenue, protect domestic industries or regulate international trade.

Dating back thousands of years, tariffs have long been a tool of economic policy. They gained prominence in the U.S. with the U.S. Tariff Act of 1789, which aimed to protect domestic manufacturing and generate revenue, and have seen a resurgence in use as a policy tool under the Trump Administration.