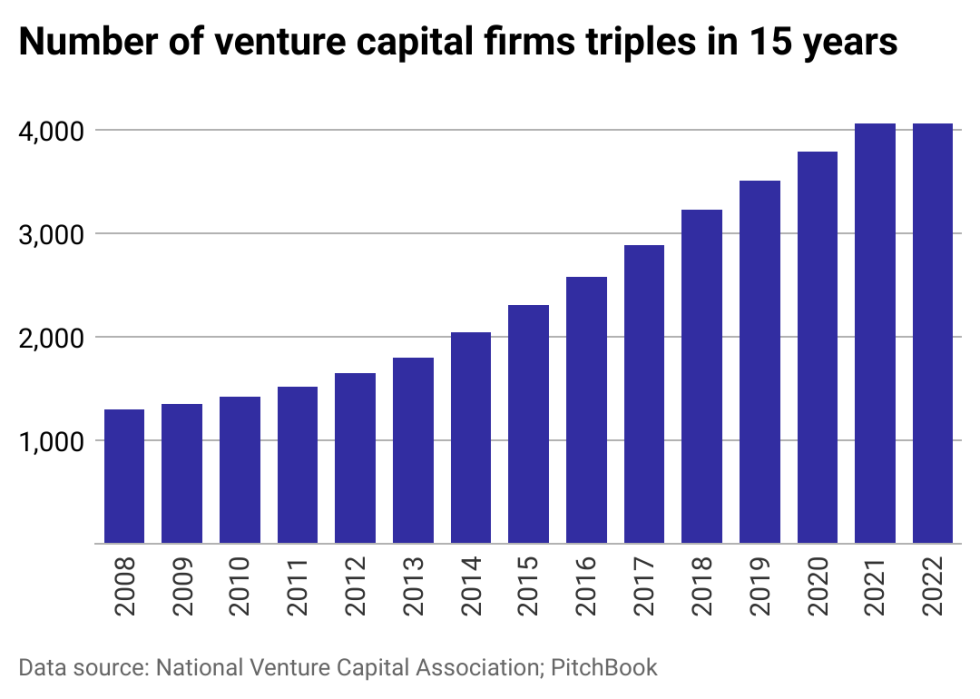

How US venture capital has grown in the last 15 years

Venture capital has recovered steadily from the global financial crisis. From 2008 to 2022, the number of venture capital firms increased from about 1,000 to a little over 4,000, a 300% increase.

The period saw a surge in the development of "seed funding," the initial funds raised in exchange for shares in the company, and it became an investment class in its own right. This expanded access in investing in the earliest stage of companies to a broader array of investors beyond traditional friends, family, and angel investors, catalyzing new growth and opportunities.

The industry saw the proliferation of new funds specializing in specific areas, such as software, biotech, and the environment. Venture capital firms also began creating multiple funds with different investment strategies, diversifying their portfolio and increasing revenue from management fees.

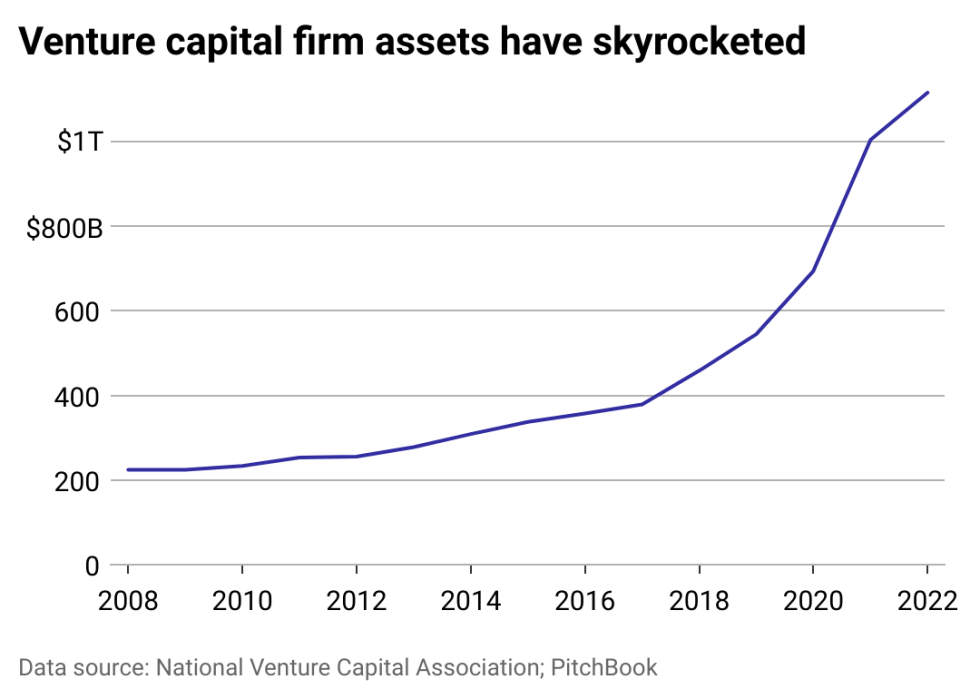

Venture capital firm assets—which refer to the total value of everything a firm owns, including investments, intellectual property, office space, and bank accounts—have jumped considerably in recent years. The moderate growth that followed after 2008 began increasing in pace, noticeably in 2012, then more sharply upward starting in 2017.

The estimated value of venture capital-backed companies, known as valuations, rose consistently during this period, buoyed by a long period of low interest rates and high credit availability. The COVID-19 pandemic outbreak blunted the rate of increase, but it picked up again in the later quarters of 2020 and still remains elevated above historical levels.

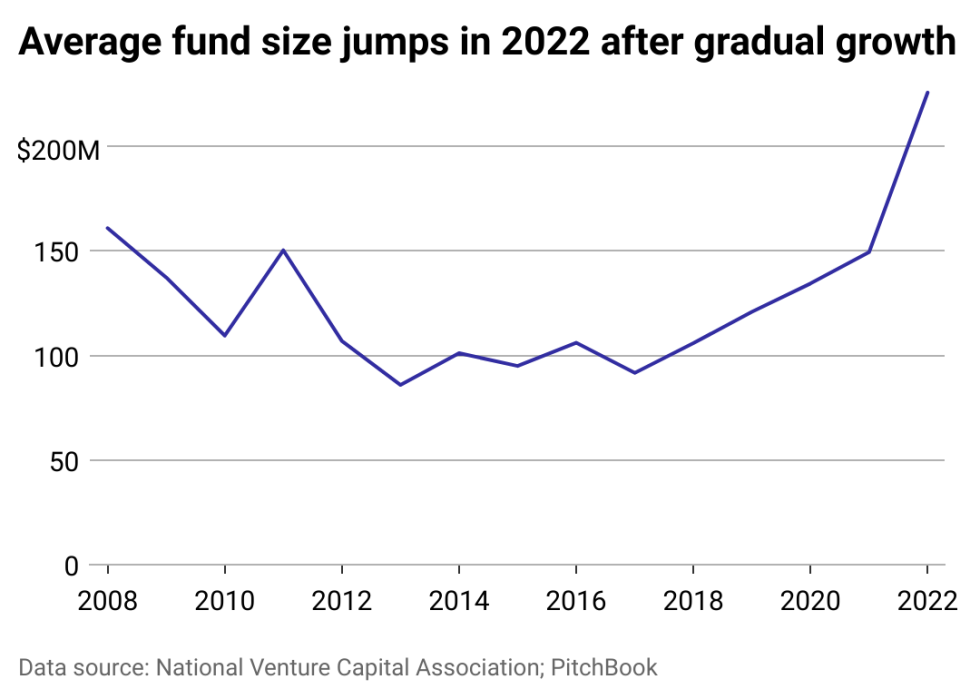

After five years of steady increases, in 2022, the average venture capital fund size, the amount of capital raised for investing, suddenly soared from $150 million to over $200 million.

This growth was propelled by several factors. One was the entrance of mega funds, or funds with $500 million or more in capital, backed by institutional and sovereign investors seeking bigger and more diverse investing opportunities.

Low interest rates made it easy for startups to get funding and get off the ground. The rise in the number of companies that successfully went public on the stock exchange, allowing investors to earn hefty returns, brought about a gold rush mentality of founders and investors chasing the same results.

Story editing by Ashleigh Graf. Copy editing by Paris Close. Photo selection by Ania Antecka.