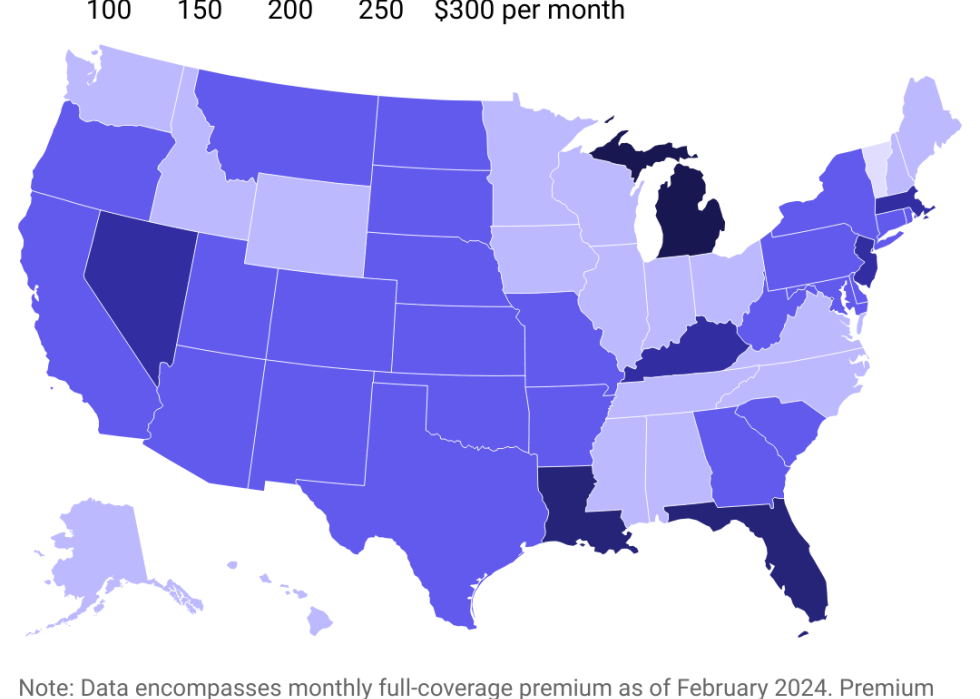

The states where people pay the most in car insurance premiums

There are common denominators among the five states where it's most expensive to have car insurance: Michigan, Florida, Louisiana, Nevada, and Kentucky. Washington D.C. is another pricey locale, ranking #4 overall.

Three of these six are no-fault jurisdictions and require additional coverage beyond coverage to pay for medical costs. Michigan notably calls for $250,000 in personal injury protection (though people with Medicaid and Medicare may qualify for lower limits), $1 million in personal property insurance for damage done by your car in Michigan, and residual bodily injury and property damage liability that starts at $250,000 for a person harmed in an accident.

Other commonalities between these states include high urban population densities. At least 9 in 10 people in Nevada, Florida, and Washington D.C. live in cities and urban areas, which leads to more crashes and thefts and high rates of uninsured drivers and lawsuits. Additionally, Louisiana, Florida, and Kentucky rank #5, #8, and #10, respectively, in motor vehicle crash deaths per 100 million vehicle miles traveled in 2021 based on Department of Transportation data analyzed by the Insurance Institute for Highway Safety.

- Monthly full-coverage insurance: $210

- Monthly liability insurance: $57

- Monthly full-coverage insurance: $232

- Monthly liability insurance: $107

- Monthly full-coverage insurance: $253

- Monthly liability insurance: $77

- Monthly full-coverage insurance: $270

- Monthly liability insurance: $115

- Monthly full-coverage insurance: $304

- Monthly liability insurance: $113

Story editing by Carren Jao. Copy editing by Paris Close. Photo selection by Lacy Kerrick.