As tariffs loom and global currency values fluctuate, goods from these top US trade partners may shift in price

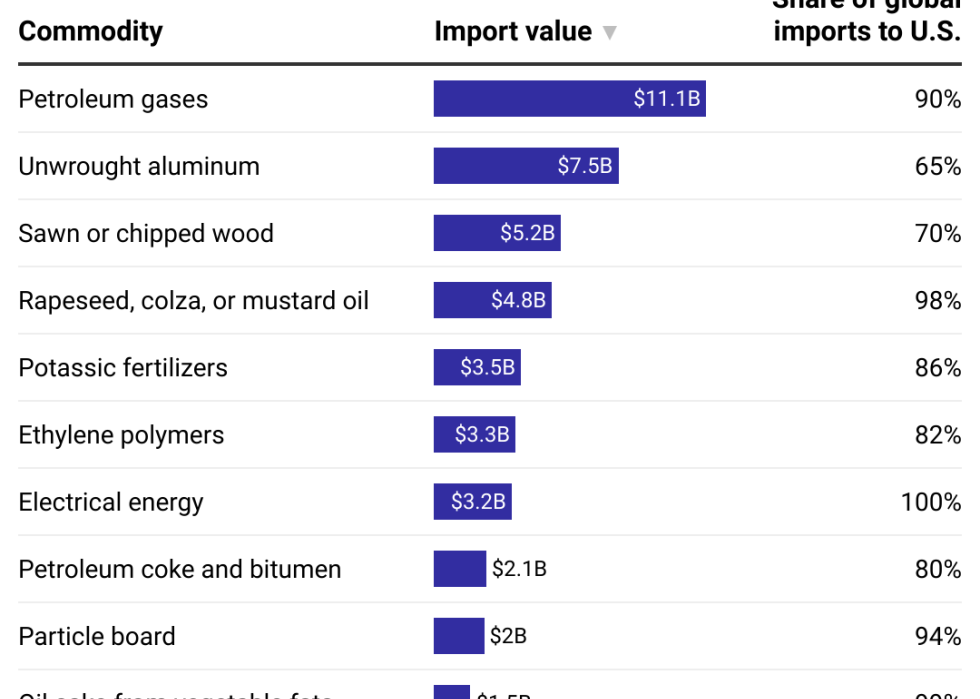

Critical supplies like fertilizer and construction materials hang in the balance of any potential trade dispute between the U.S. and Canada. Our northern neighbor's dominance in rapeseed oil—which contributes to animal feed and biodiesel, among other uses—and fertilizer exports to the U.S. (98% and 86%, respectively) means any disruption could increase both American farmers' production costs and cut into food manufacturers' bottom lines. That potentially means higher prices at the grocery store and the gas pump. It could also cut into home heating costs for households that rely on heating oil, up to 30 cents per gallon.

Workers in U.S. manufacturing could feel the pinch if Canadian wood products and aluminum become harder to source. Consumers, already wrestling with sky-high prices and persistent inflation, could see everything from home renovation costs to certain Canadian-assembled vehicles get pricier, like the Toyota Rav4 SUV and Honda CR-Vs and Civics.

Because Canada's economy largely relies on the export of commodities, its currency is prone to fluctuations, particularly during times of volatility. The U.S. and Canadian dollars have a close relationship; aluminum and steel, two major exports from Canada to the U.S. may be impacted amid ongoing tariff uncertainty that began in early 2025.

But the possibility of tariffs remains, which could bring business activity down and encourage Canadian financial regulators to keep cutting interest rates and weaken the currency by making it less attractive to foreign investors.

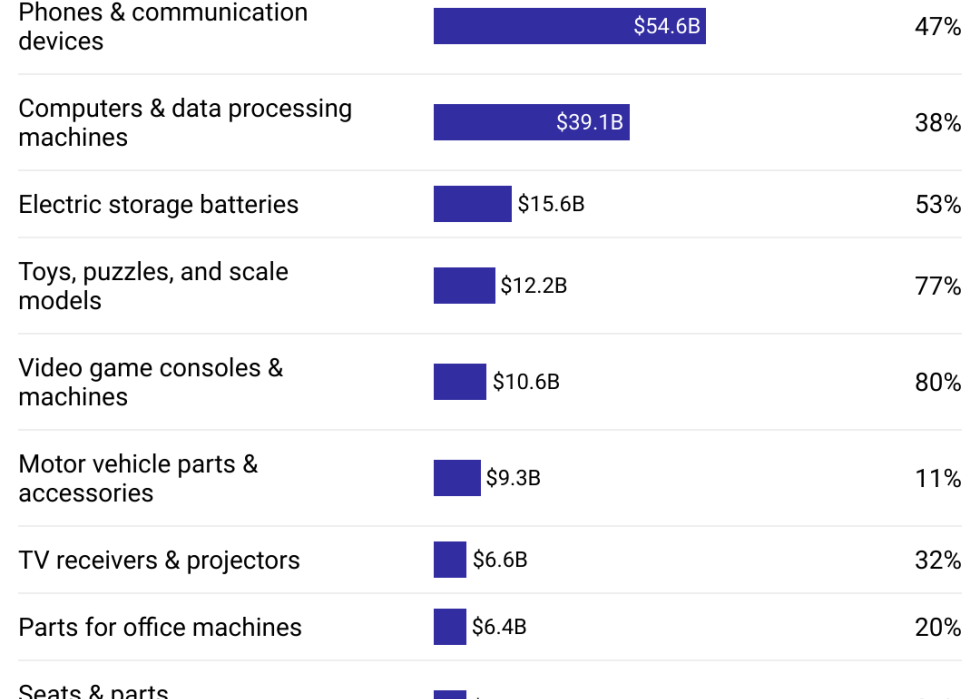

China's grip on U.S. tech supply chains runs deep, with American companies heavily dependent on Chinese-made components for everything from smartphones ($54.6 billion in import value) and computers ($39 billion in import value) to gaming consoles (where China supplies 80% of U.S. imports).

Higher component costs and supply disruptions could force U.S. tech companies to accept lower profit margins and cut costs, including wages and jobs, as companies did during the tariff wars launched in 2018. This has a profound effect on American software developers, engineers, and manufacturing workers who designed and built these devices, costing American companies an estimated nearly $46 billion.

For consumers already struggling with high prices, trade tensions with China could mean significantly higher prices on everyday electronics like phones, laptops, and gaming systems, while the increased costs of electric vehicle batteries and automotive components could push new car prices even higher.

Even though China was the first country that Trump imposed new tariffs on in his second term, the tightly-managed yuan, with its fixed exchange rate, is actually slightly stronger than when he took office. China's targeted but limited reaction leaves open the possibility of a bigger trade deal to avoid a full-throated trade war.

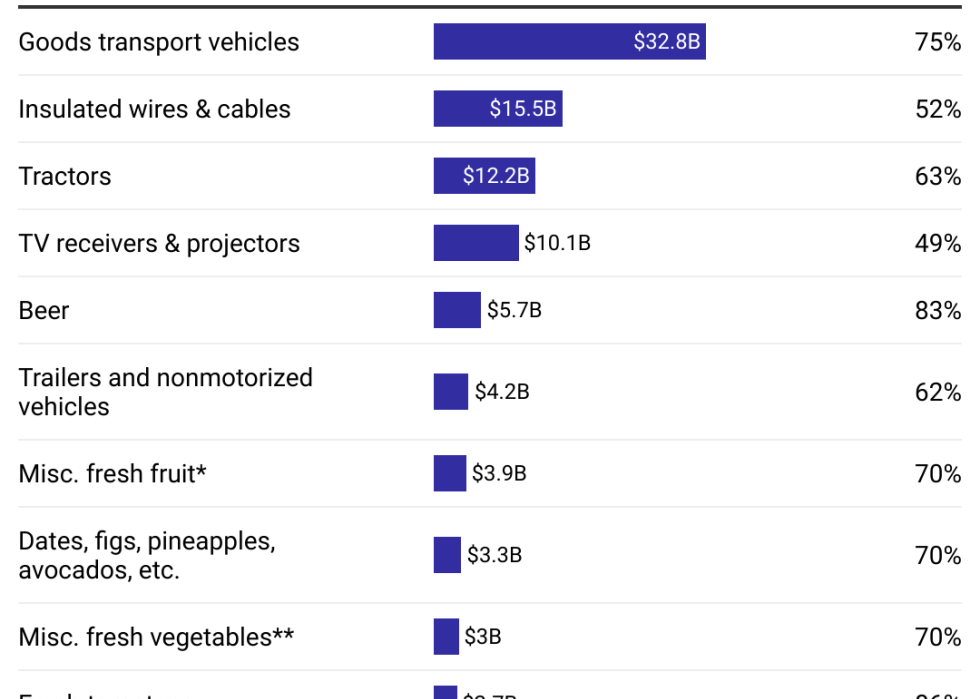

U.S. and Mexican auto industries are deeply intertwined through $32.8 billion in vehicle trade and complex supply chains that account for 75% of U.S. auto imports. A disruption in trade between the two countries could lead to job impacts and layoffs for American auto industry workers, from assembly line staff to dealership employees. It could also raise prices on vehicles imported from Mexico.

American shoppers already dealing with higher grocery bills could see even steeper prices for everyday items like tomatoes, nuts, avocados, and beer (where Mexico supplies 83% of imports), making weekly shopping trips more expensive for already stretched household budgets. Various tariff threats have sent the already volatile peso swinging this year, from declines of 2.2% to gains as high as 3.5%. If the threatened 25% tariffs do go into effect, experts say the peso could fall even further, and Mexico's economy could slide into recession.

Story editing by Alizah Salario. Additional editing by Elisa Huang. Copy editing by Tim Bruns.