What a difference a dollar makes: These are the metros where your paycheck stretches the furthest

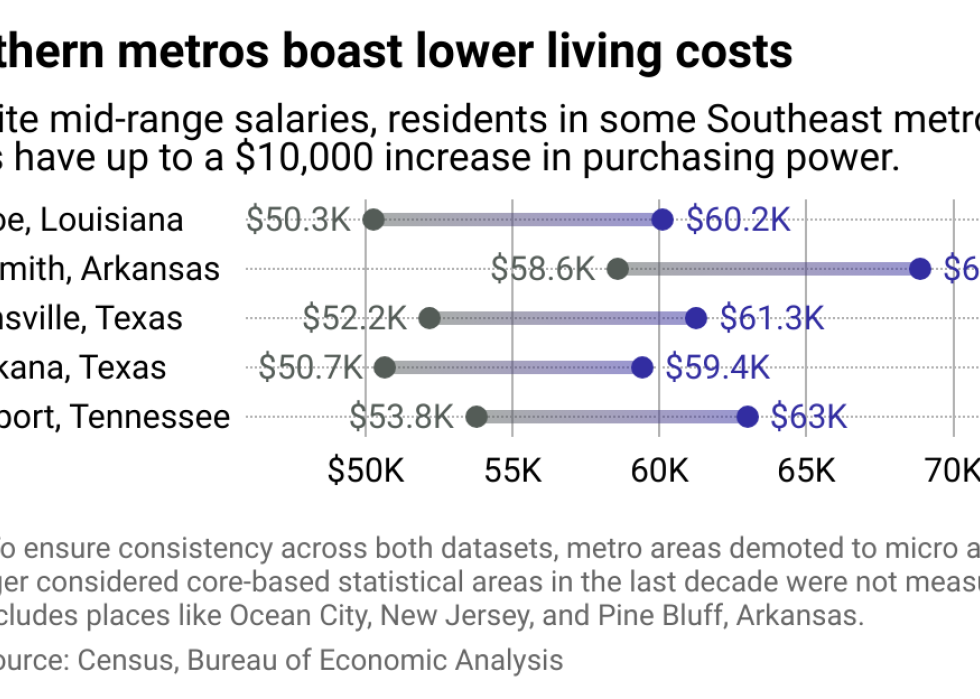

The financial geography of America shows there are zones where modest incomes translate into larger lifestyle gains. While Southern households earn less on paper, $73,280 in 2023 versus the national median of $80,610, according to the Peter G. Peterson Foundation's analysis of Census Bureau data, their money performs better at the cash register thanks to lower regional price parities.

Take Fort Smith, Arkansas, a manufacturing and health care hub. As of March 12, 2025, gas pumps show $2.74 per gallon versus the national $3.09 average, giving drivers a 12% discount every time they fill up. A dozen large eggs at Aldi rings up at $6.59, undercutting the national wholesale average of $6.85 as of March 7. The real discounts, however, are seen in housing, where average rents run just $1,000 monthly as of March 11, according to Zillow—barely half the national average of $2,050.

Kingsport, Tennessee, tells a similar story. Health care, manufacturing, and education power the local economy, while gas prices as of March 12 cost $2.74 per gallon. A dozen large eggs at Food City will run you $6.99. At $1,300 monthly on average, housing still delivers a substantial $750 monthly discount versus the national norm.

These price differentials explain why many Southerners living on seemingly modest incomes might enjoy more disposable income. The raw numbers on a paycheck only tell half the story. What those dollars can buy determines the relative degree of financial comfort.

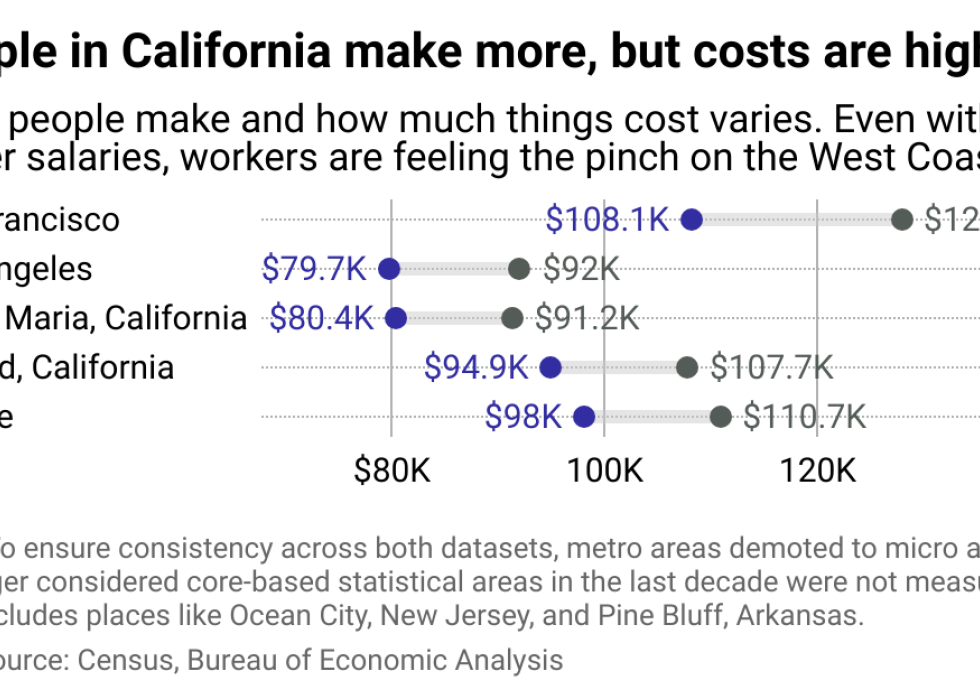

The tug of the West Coast's economic rip current makes higher paychecks feel smaller. As of March 12, San Francisco residents shell out $9.99 for a dozen eggs and $4.85 per gallon at the pump. The average rent is an eye-popping $3,195 monthly. In Los Angeles, where entertainment and logistics drive the local economy, prices are also toasty: $9.99 eggs, $4.68 gas, and $2,748 monthly rent can quickly eat up paychecks. The math reveals why so many six-figure earners still feel cash-strapped. Higher regional price parities in these metros effectively downsize those impressive salaries.

The where-to-live equation isn't just about mortgage payments and receipts. Sure, savvy consumers crunch numbers on the full financial picture, calculating and comparing the various taxes, commutes, insurance, and groceries between ZIP codes. Still, life can't be boiled down to just a spreadsheet. People might want to live near family for closeness and help with child care. Others might need nearby nature access to regain peace on the weekends or to be in the right school district for their kids.

As part of deciding to move, consider the regional price parities and the return on happiness. A longer commute might allow you to live in a bigger house or quieter, nature-filled neighborhood, but that drive will shave hours off your life each week. Even a remote job can be stressful in terms of feeling socially or professionally isolated. One good idea is to try renting near where you're thinking of living for a week or weekend and see what it's like to be in the rhythm of the neighborhood. What makes a house a home is a balance of lifestyle and affordability.

Story editing by Carren Jao. Copy editing by Paris Close.