Inflation and economic factors drive 38% of people to get a side hustle

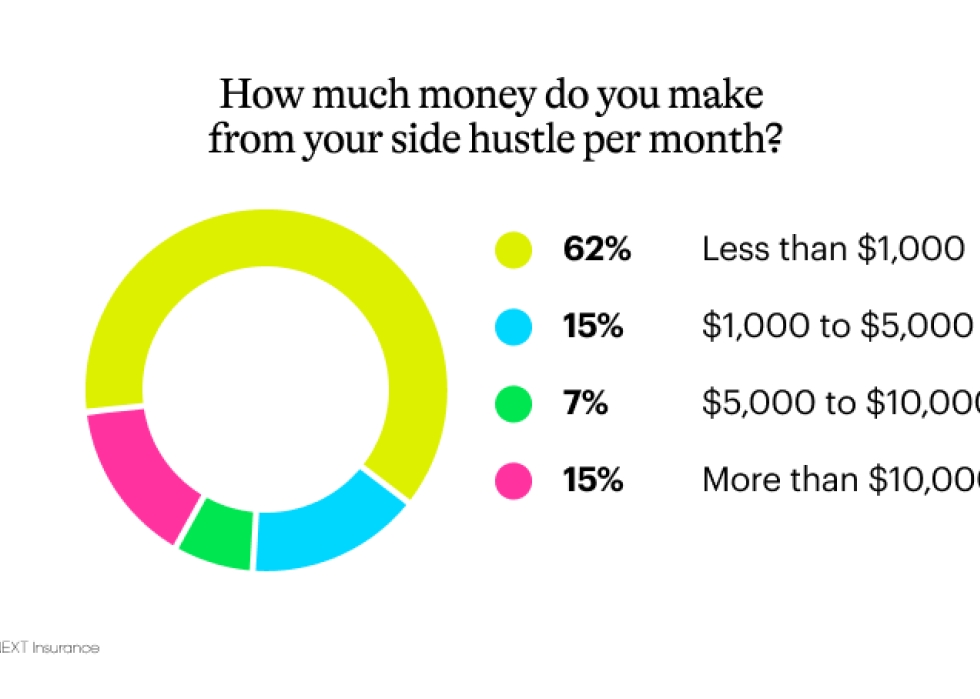

While many have taken up a side hustle, it remains exactly that: a side job and not a way to make a living. The survey revealed that the majority of side hustles (62%) earned less than $1,000 per month.

Twenty-two percent of side hustles earned between $1,000 and $10,000, while 15% earned over $10,000 monthly.

Over a quarter (28%) of respondents turned around and spent their earnings to help make ends meet.

This comes as no surprise as Americans are experiencing record inflation across the board, eating into their wallets. Food prices increased by 10% in 2022 (faster than any year since 1979) and again by 6% in 2023. Gas prices peaked at $5.02 per gallon in 2022, and electricity prices are outpacing annual inflation rates.

- 20% of respondents reinvested in their side hustles.

- 18% saved their earnings in savings accounts and 401Ks.

- 11% reinvested in themselves through training and courses.

- 5% invested in social media campaigns and ads for their side hustles

- 31% of respondents used their earnings for other purposes.

Most people don't buy business insurance for side hustles

Only 27% of respondents reported having business insurance for their side hustles, leaving a significant majority (73%) without coverage.

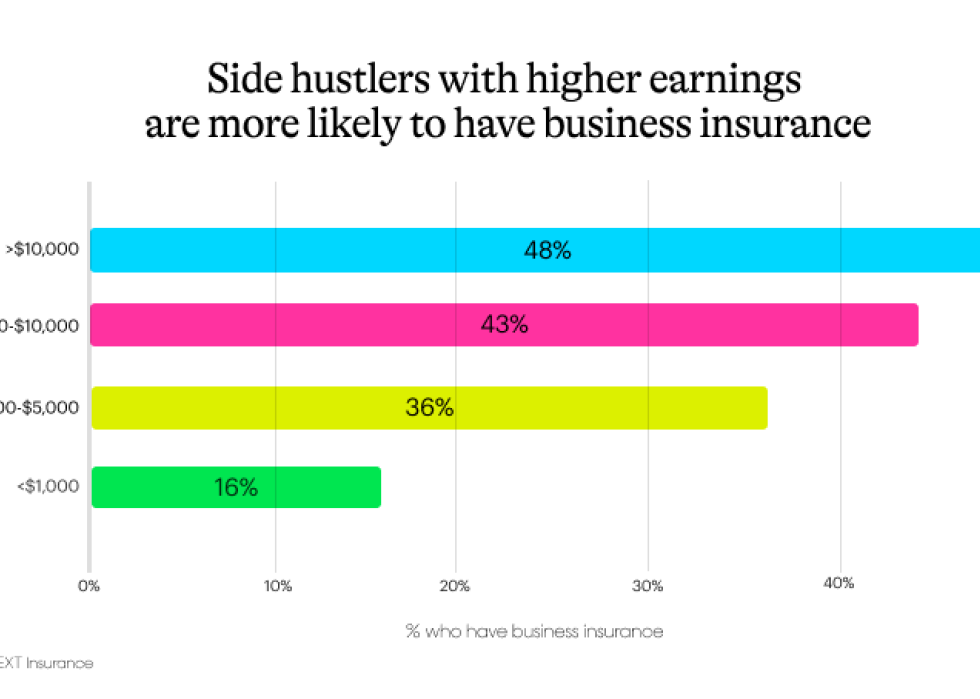

Results indicated a positive correlation between side hustle earnings and the likelihood of having business insurance. The more respondents earned, the more likely they were to protect their businesses.

Many people with side gigs may think, "Why should I get business insurance? It doesn't warrant it." But even side gigs have risks associated with them. You don't need to be an established, full-time business owner to have to pay for damages or get caught in legal disputes.

Here's how business insurance can protect side hustles.

Protection against liabilities

Business insurance safeguards businesses from potential liabilities, such as accidents and injuries, property damage or legal claims. It can help cover the costs associated with these incidents, protecting your personal finances.

For instance, if you sell things in an Etsy store, business insurance can help protect against product liability. Or, say a very angry client wants to take you to court because they claimed you did a terrible job. Professional liability coverage can help pay for some of your defense expenses (up to the limits of your policy), including your lawyer and legal fees.

Business continuity

Things you can't plan for, like a fire, water damage, accidents or theft, can stop a side job and make it hard for a business to operate. Business owners can lessen these risks if they have the right coverage.

For example, business interruption insurance can help pay for lost income and ongoing expenses if a covered event briefly stops your side hustle from running. This coverage can help side hustlers get back to work without losing a lot of money.

Protection of your investment and sweat equity

Sometimes, having a side hustle can feel as demanding as your main job, especially when facing the uncertainties and risks associated with business operations. Having business insurance can offer the reassurance you need, allowing you to focus on growing the business and pursuing passions without constantly worrying about potential risks.

Similarly, business insurance encourages those who want to venture into entrepreneurship via a side hustle or go full-time with it. Think of it as a safety net for your finances.