A government shutdown halts pay for 2.8 million federal workers. Here's where it would hit them hardest

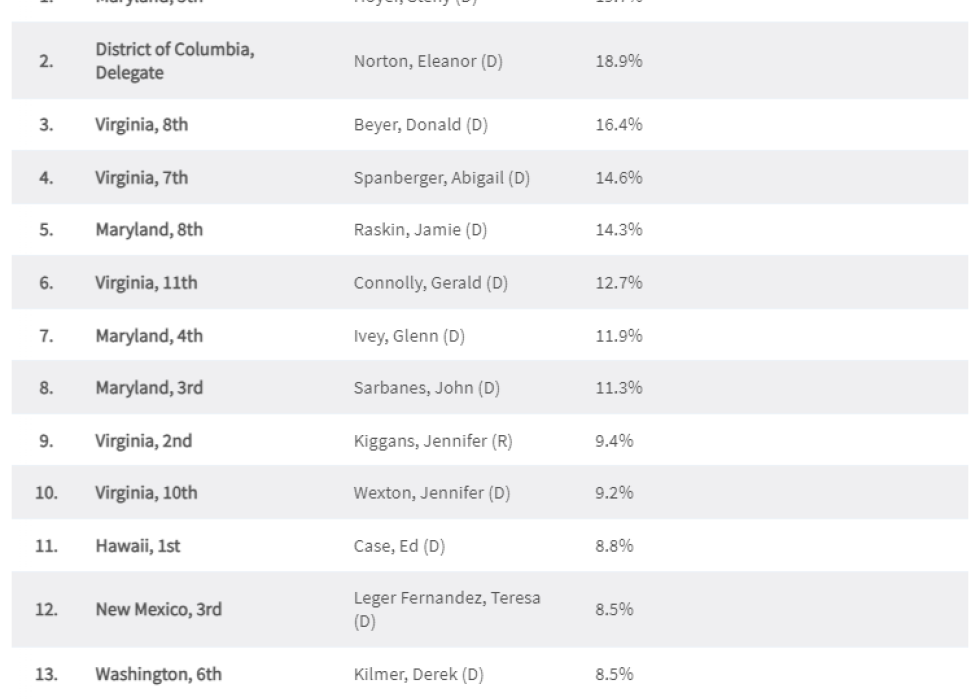

Given their proximity to the nation's capital, nine out of ten congressional districts with the highest percentage of federal workers are in Maryland and Virginia. The densest is Maryland's 5th district, where the federal government employs 20% of the workforce.

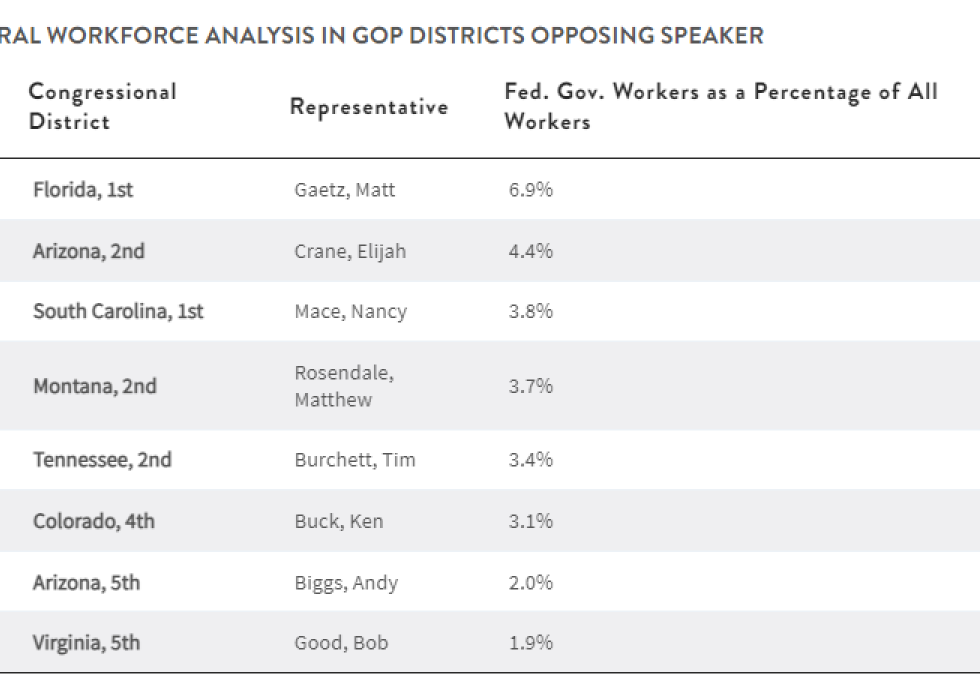

Represented by Rep. Matt Gaetz, — who initiated the vote against former Speaker McCarthy — Florida's 1st district is home to approximately 25,000 federal employees (7% of the local workforce). Of the seven other Republican representatives who supported the Speaker's removal, Arizona's 2nd district ranks next with 4% of its workforce in federal sectors.

MoneyGeek also examined the distribution of federal government workers and the potential impact on wages for these individuals at state and metropolitan levels.

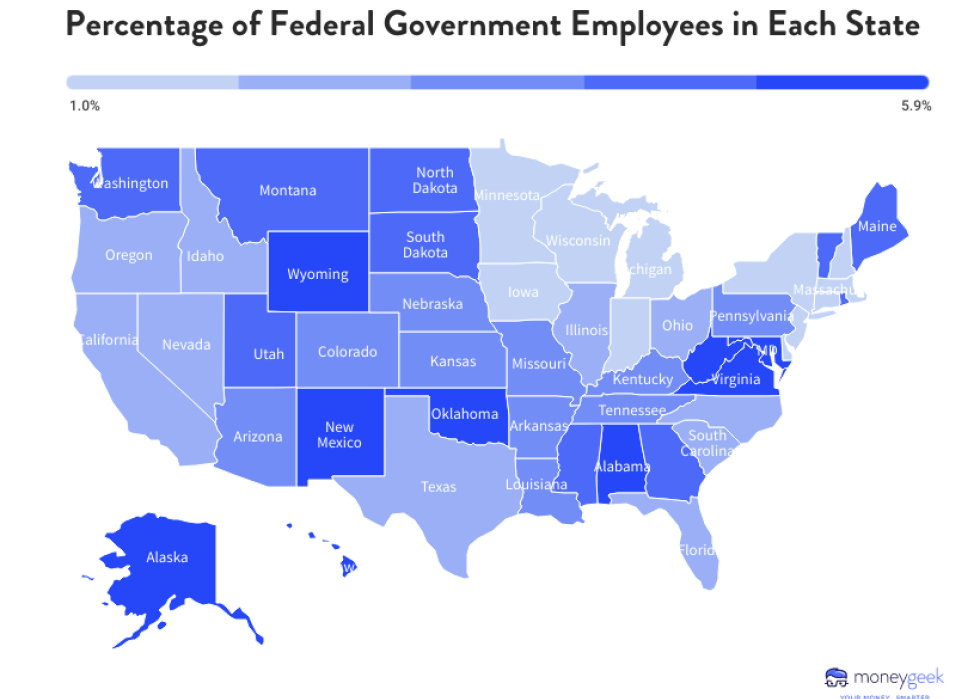

Maryland stands at the forefront with roughly 155,000 federal government workers, making it the state that would face the most significant impact from a government shutdown. These individuals represent 6% of the local workforce, and a shutdown of just one week could mean $378 million in unearned wages. Next are Hawaii and Alaska, where 5.5% and 5% of the workforce are federal employees, respectively. A shutdown in these two states could freeze $88.7 million per week in wages.

The California-Lexington Park metro area has the highest percentage of federal workers at 22%, while farther west, the Bremerton, Washington, area holds the second-highest concentration at nearly 22%. Closely following are select metro areas in Georgia and North Carolina, where federal employment exceeds 12% of local populations.

What can federal employees do about a shutdown?

Although temporary — laws ensure retroactive payment upon resumption — the pay halt caused by a government shutdown can disrupt workers' financial stability and affect their ability to manage routine expenses or service debt. Small businesses may also experience processing delays for lending and lost profits, which can trickle down and impact workers. Here are some proactive measures to navigate this financial hiccup:

Stay informed

- Familiarize yourself with the Federal Employee Civil Relief Act, which (if enacted) would allow a debt payment forbearance post-shutdown.

- Understand the provisions of the Government Employee Fair Treatment Act, which mandates retroactive pay for furloughed employees or those working without pay during the shutdown.

- Keep abreast of guidance from the Office of Personnel Management (OPM) regarding pay and benefits during a shutdown.

Budget and save

- Smart saving strategies allow you to build a financial cushion that can help mitigate the impacts of delayed wages.

Communicate with creditors

- Inform lenders about the temporary halt in your income and negotiate extended payment terms if needed.

Methodology

MoneyGeek utilized Quarterly Census of Employment and Wages (QCEW) reporting by the Bureau of Labor Statistics (BLS) for state and metropolitan area data to determine the areas with the largest percentages of federal government workers relative to the total local workforce and their average weekly wages. Data is from the first quarter of 2023 and considers all 50 states and 381 metropolitan areas.

For federal government employee data in U.S. congressional districts, we used the Census Bureau's 2022 1-year American Community Survey. Our list of representatives and the 436 districts they represent came from the U.S. House of Representatives directory.

Limitations: The BLS QCEW excludes the following groups from the category of "federal government": "elected officials in the executive or legislative branch, members of the armed forces or the Commissioned Corps of the National Oceanic and Atmospheric Administration, individuals serving on temporarily in case of fire, storm, earthquake, or other similar emergency, and individuals employed under a Federal relief program to relieve them from unemployment."

This story was produced by Moneygeek and reviewed and distributed by Stacker Media.