The most "average" cities in America (for credit and debt)

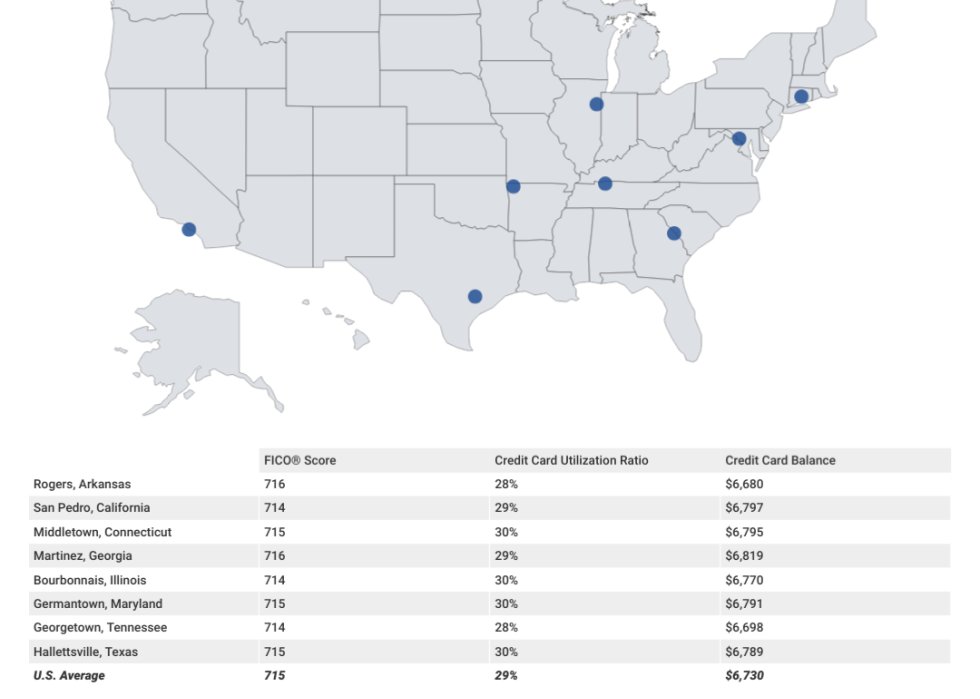

The "most average" cities for credit card debt didn't cluster in one state or region, which seems to illustrate that credit card usage is not correlated with where a cardholder lives.

A factor that may inform this finding is that credit card APRs are relatively uniform across the country. In other words, if you have a 715 FICO® Score and a 29% utilization rate, you'll most likely receive the same APR from a credit card issuer whether you reside in Lubec, Maine, or Eureka, California.

Additionally, costs for oft-purchased goods and services are similar in each region. Airline travel isn't cheaper in one time zone versus another, for example. Similarly, many common credit card purchases, such as streaming services and nationally available merchandise, also cost the same for U.S. consumers regardless of location.

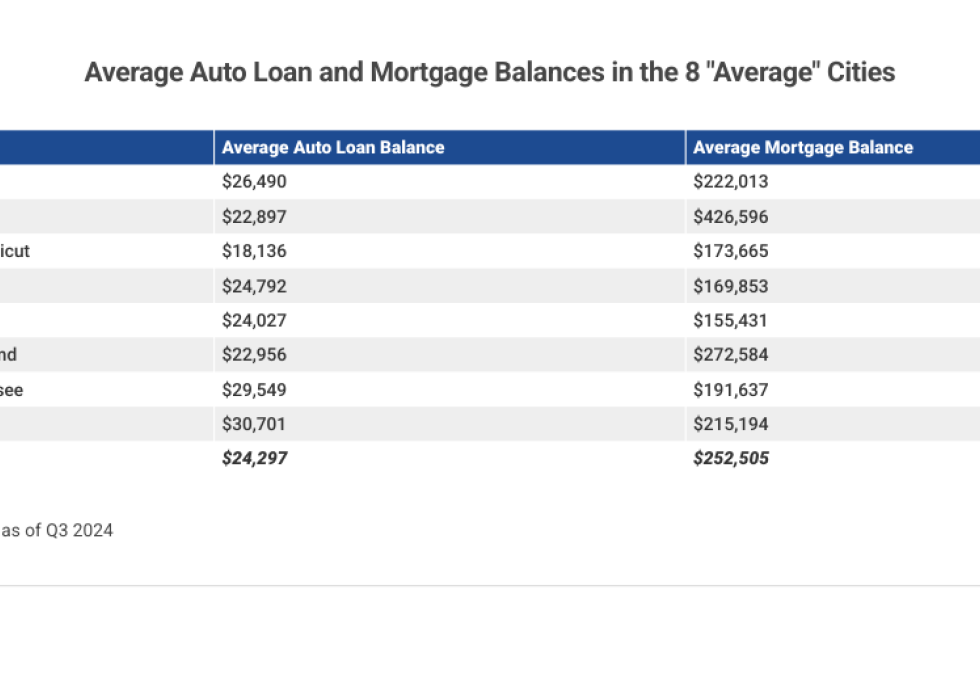

In contrast to the findings on credit card balances, average auto loan and mortgage balances in the list of average cities align more with their region than the national American average.

For instance, the national average auto loan balance was $24,297 as of September 2024. However, auto loan balances ranged from an enviable $18,136 in Middletown, Connecticut, to a balance exceeding $30,000 in Hallettsville, Texas.

But there's a simple explanation: The average auto loan balance in Connecticut barely exceeds $20,000, while the statewide average in Texas is the highest in the nation at $29,760.

A similar story plays out with mortgage balances. San Pedro, California, currently sports a mortgage balance of $426,596. Meanwhile, average mortgage balances in Bourbonnais, Illinois, are $155,431, less than half of those in San Pedro and other California cities.

Again, look to the local market for an explanation: The median home price in California exceeded $800,000 in December 2024, according to Redfin data, while the median home price in Illinois was less than half that at $282,500.

A Middling Conclusion

Although it may be tempting to label these namechecked U.S. cities and towns as incredibly average, perhaps typical is a better description. Will they also prove to be a bellwether in future years, as the broader economy moves on throughout the 2020s? Some may zig while others zag, and others still may stay the course and continue to follow national trends.

Changes may be more pronounced in some "average" towns than others, such as in fast-growing Rogers, Arkansas. Boomtowns can continue to grow, but can also bust—perhaps not as dramatically as in the North Dakota oil towns of the 2010s, but decline nonetheless. Experian will keep tabs on these average towns this time next year, to see just how representative they remain.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.