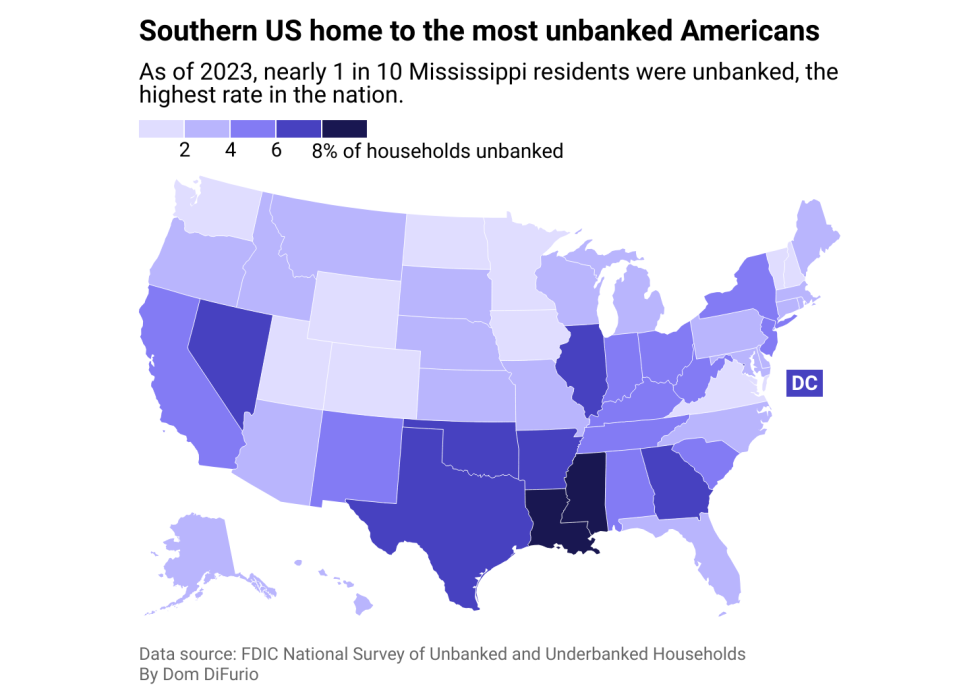

How Oklahoma's unbanked population compares to the rest of the US

An FDIC survey of unbanked Americans in 2023 found that the most common reason cited for not having a bank account was an inability to meet minimum balance requirements. Banks typically require customers to deposit between $25 to $100 to open a checking or savings account, according to the Consumer Financial Protection Bureau. Survey respondents said they also do not trust banks and are concerned about the fees associated with using them.

However, there are other reasons besides trust that keep Americans excluded from the financial system. Some avoid banks to increase their sense of privacy. Others reported that bank locations and hours of operation were inconvenient.

States with the largest populations of unbanked individuals are also states with significant Black populations that have historically been intentionally excluded from participating in the banking system by racist policies and practices.

Black-owned banks originated during the post-Civil War era to serve communities excluded from the mainstream financial system. But banks serving majority Black communities have been on the decline over the past two decades, severely limiting access to financial services. Today, majority Black and Latino or Hispanic neighborhoods have fewer choices in banks to go to than majority white neighborhoods, meaning they live in a less competitive environment for banks and are potentially subject to higher service rates, according to a 2021 Brookings Institution analysis.

Digital banking has exploded over the past decade and promises to eliminate many barriers to using financial services, like lack of transportation. However, there are still people who rely on physical banking. FDIC surveys have shown that low-income Americans and those with lower education levels are more likely to use in-person banking services—something banks have divested from as they move more of their operations online.

One of the more significant events that has pushed more Americans toward opening bank accounts in recent history had to do with extreme necessity: the government stimulus checks issued during the COVID-19 pandemic. Almost half of unbanked Americans who began using banks in that period said the stimulus was a reason they opened an account, according to the FDIC.

Federal agencies have tried to increase the population of banked Americans, but a 2022 report from the Government Accountability Office found that the success of these efforts is difficult to assess. Its recommendations that the FDIC and other agencies adopt clear measurement systems for the impact of public awareness campaigns and other efforts have yet to be implemented.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story features data reporting by Elena Cox, writing by Dom DiFurio, and is part of a series utilizing data automation across 50 states and Washington D.C.