Gen Z property hotspots: Where America's youngest are buying homes

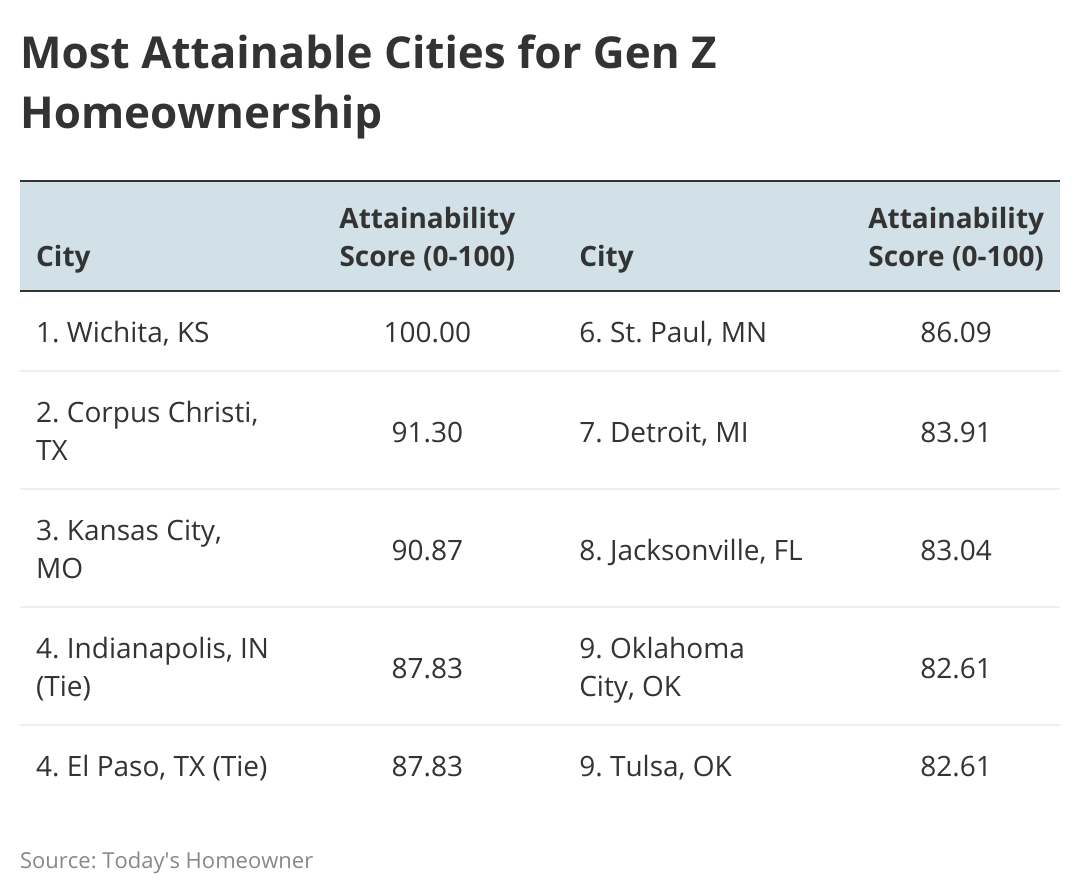

Many cities where homeownership is most achievable are in the Midwest and South. As previously mentioned, across the top 10 cities, two Texas and two Oklahoma cities are represented.

Gen Z homeownership is elusive in many Pacific Northwest cities, including Seattle, Washington, at No. 1 and Portland, Oregon, at No. 3. Additionally, five of the bottom 10 cities are in California.

Now that we know where Gen Z homeownership is (and is not) the most attainable, let's discuss each factor and the best- and worst-performing cities for each metric.

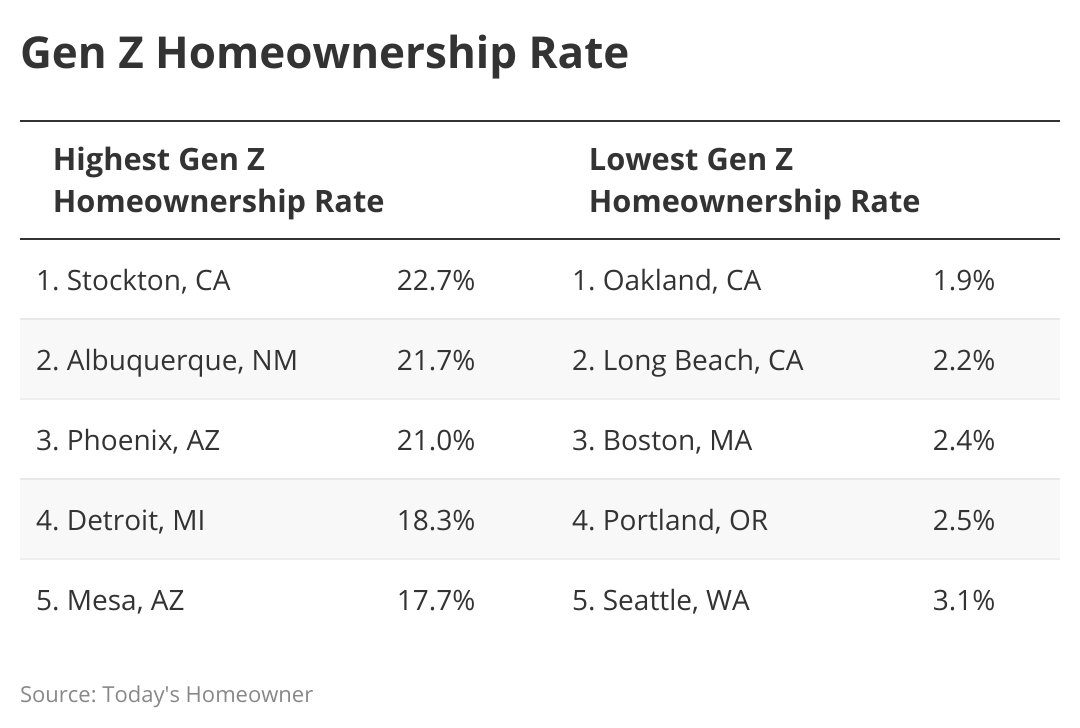

The Gen Z homeownership rate is the number of Gen Z homeowners relative to the number of Gen Z households. Two cities in Northern California have the highest and lowest Gen Z homeownership rates. Stockton has the highest rate, while Oakland (nearby San Francisco) has the lowest, despite being less than 80 miles apart.

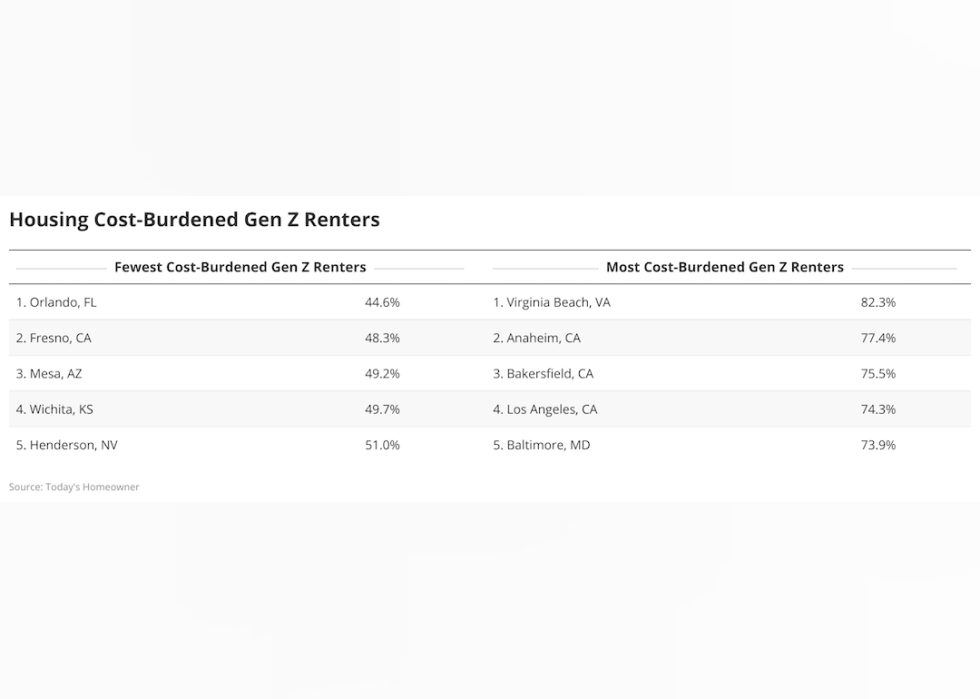

The Department of Housing and Urban Development (HUD) defines housing cost-burdened as paying more than 30% of pre-tax income on housing costs. Most Gen Z renters are housing cost-burdened. Even in the best-performing city—Orlando, Florida—close to 45% of Gen Z renters are housing cost-burdened.

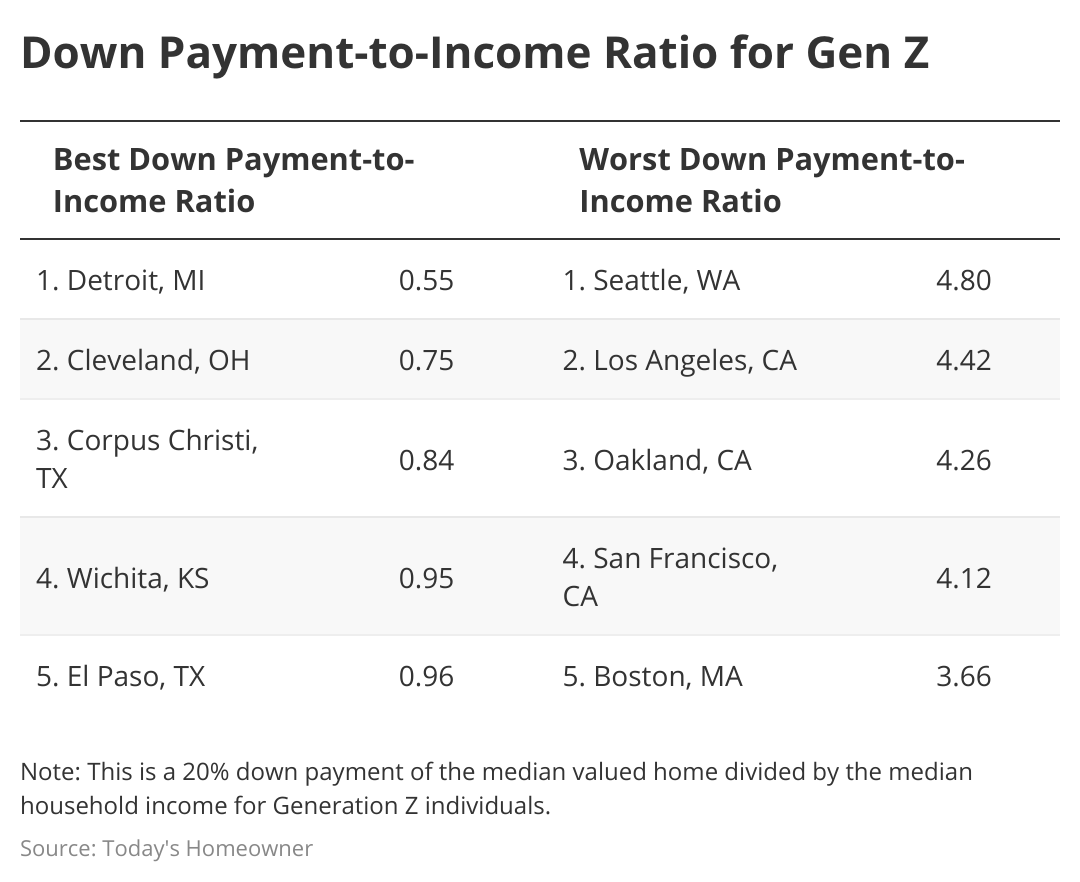

A higher down payment-to-income ratio indicates homeowners will need to spend more on their down payment relative to their income. In four cities (Seattle, Washington, and three in California), individuals would need to pay more than four times their income to afford a 20% down payment on the median-valued home.

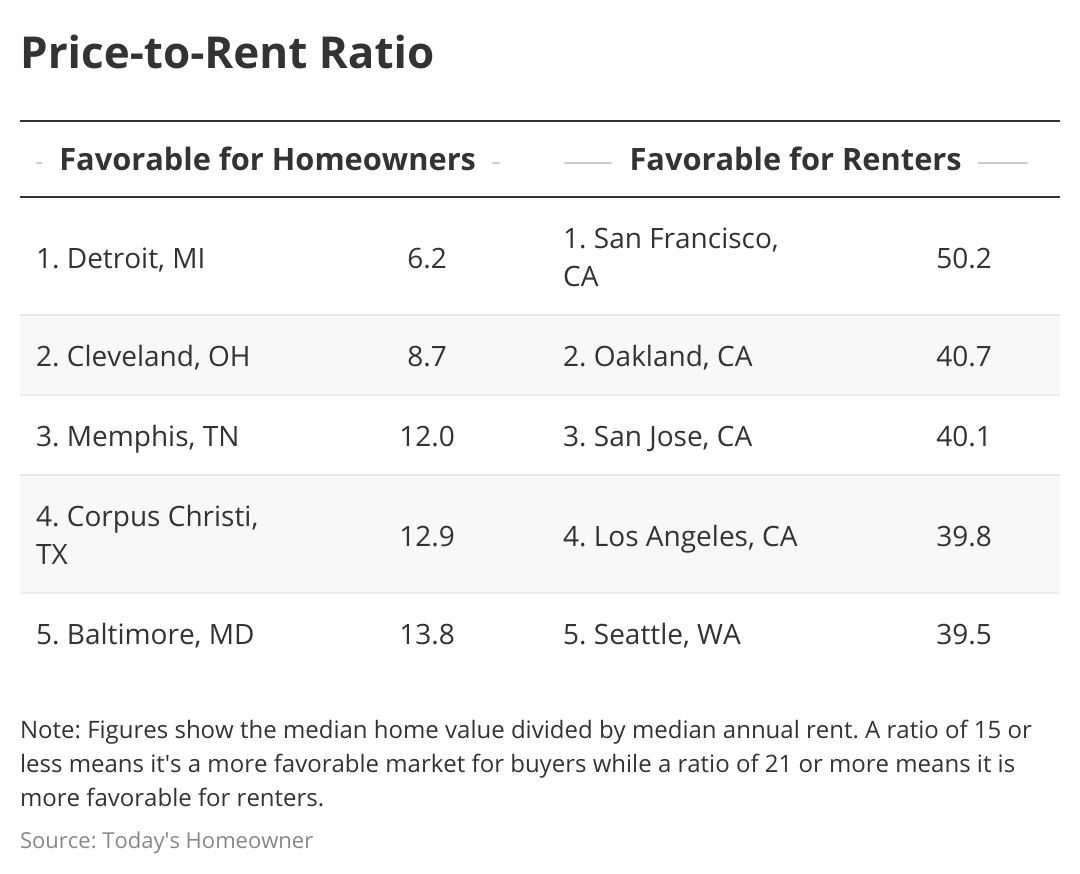

A price-to-rent ratio of 21 or more means a more favorable market for renters. In California's San Francisco, the price-to-rent ratio exceeds 50. In contrast, the Midwestern cities of Detroit, Michigan, and Cleveland, Ohio, show a more favorable environment for homeowners, with price-to-rent ratios of 6.2 and 8.7, respectively.

Young prospective homeowners may want to consider several criteria outside our analysis. These may include quality of life factors, the job market, and home value appreciation.

Quality of life factors

Wichita, Kansas is the most attainable place for Gen Z homeownership. But if your favorite activity is surfing, you probably won't want to purchase a home there.

"When choosing a property, you need to identify the amenities and lifestyle that matter the most to you," said Mitchell David, a longtime real estate agent and founder of Beach Life Premier Team. "Consider the availability of shopping centers, recreational activities, restaurants, and community services in the area."

Job market

You'll likely want to pick a home in a city where you can grow your career. According to a recent study from MoneyGeek, Provo, Utah; Austin, Texas; and Ogden, Utah, are the best cities for Gen Z job seekers.

The type of career you want to pursue may also sway your home-buying decision. For example, Kansas City, Missouri, and Indianapolis, Indiana — ranked third and fourth most attainable cities for Gen Z homeownership — are hot-spot cities for eCommerce jobs.

A hot job market will also attract more people to your city, therefore increasing your home value, which brings us to our next point:

Home value appreciation

You'll be able to buy a much bigger home if you choose to buy in a less desirable area, but your home value is less likely to increase in this case. Purchasing a small- or medium-sized home in an "up and coming" neighborhood is a much more sound financial investment. Especially if you're planning for this to be a starter home that you plan on selling. By keeping up with home repairs through a home warranty plan, your investment may pay off.

Methodology

Today's Homeowner compared 70 of the largest U.S. cities across four metrics to rank the most and least attainable cities for Generation Z homeownership. We explain these four metrics below and their sources:

- Gen Z homeownership rate. This is the number of Generation Z homeowners divided by the total number of Gen Z households.

- Percentage of Gen Z renters who are housing cost-burdened. This is the percentage of Gen Z renters spending 30% or more of their pre-tax income on rent.

- Down payment-to-income ratio. This is a 20% down payment of the median-valued home divided by the median household income for Gen Z individuals.

- Price-to-rent ratio. This is the median home value divided by the median annual rent. A ratio of 15 or less means a more favorable market for buyers, while a ratio of 21 or more is more favorable for renters.

Data for all metrics comes from the Census Bureau's 2021 1-year American Community Survey.

We calculated an average ranking using the four metrics above and weighting them all equally. The most attainable city scored 100, while the least received a 0.

This story was produced by Today's Homeowner and reviewed and distributed by Stacker Media.