Half of renters pay more than 30% of their income on shelter amid worsening affordable housing shortage

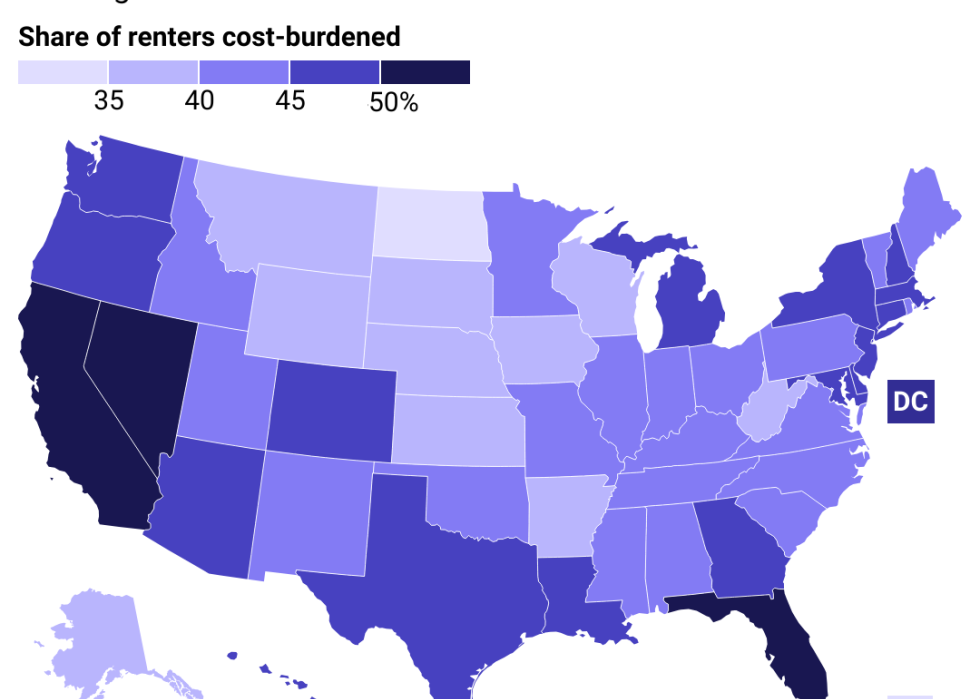

States with high costs of living, like California, New York, and Maryland, are more likely to have rent-burdened populations. However, other states long thought to have comparably affordable housing markets also had high percentages of cost-burdened renters in 2023.

California's housing crisis began spilling into neighboring Nevada as Golden State dwellers started flocking to Silver State communities in the mid-2000s. Home prices in Nevada skyrocketed due to increased demand, just like California incomes, which were about 93% higher than those of Nevada residents moving within the state, according to a 2024 paper by Lied Center for Real Estate at the University of Nevada, Las Vegas.

The cost of rent in the state also went up, increasing by 34% between 2019 and 2023, according to a 2024 report from Zillow. Coupled with wage growth that didn't keep up with rental increases from 2019 to 2023, renters have been left feeling squeezed and disillusioned about the prospects of owning a home.

The unsustainable demand for housing hasn't only made homeownership out of reach—it's also kept rental costs much higher than low-income renters can reasonably afford. Florida, California, and Hawai'i also had above-average-sized populations of rent-burdened residents in 2023.

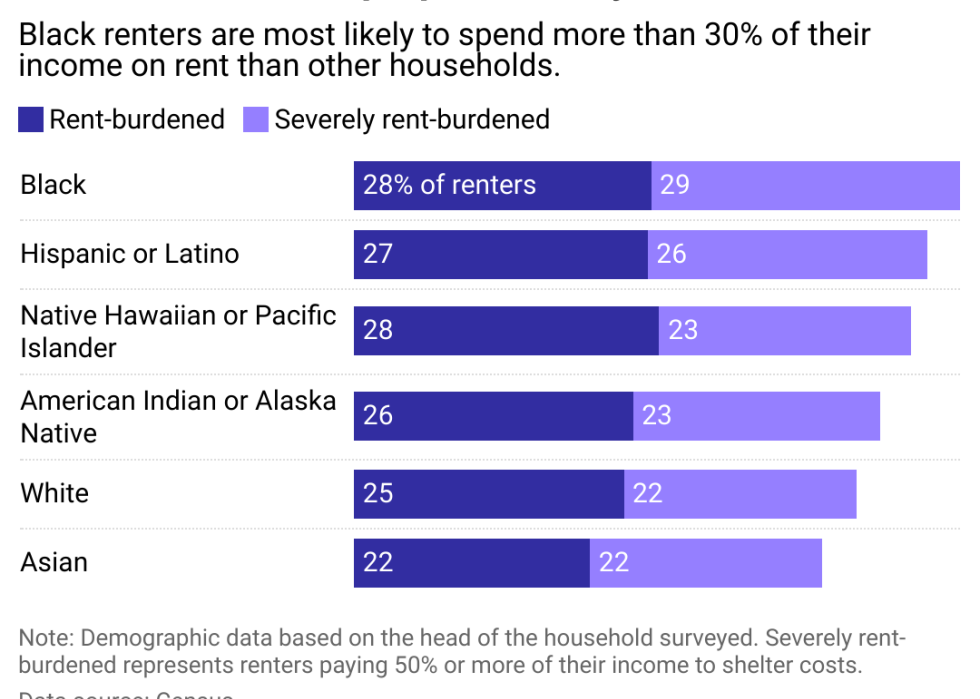

Not all renters experience the same pressure on household budgets. Renters of white and Asian descent are less likely to be rent-burdened. Households led by Black, Hispanic or Latino, Native Hawaiian or Pacific Islander, and American Indian or Alaska Native individuals experience the highest rates.

As more of the overall renting population has grown rent-burdened since 2000, the disparities experienced by Black and Hispanic or Latino renters in comparison to white renters have held, according to historical Census data. Rent burden is more likely to impact households earning less than middle income, a demographic that has long been disproportionately made up of Black and Hispanic people.

Organizations like the NLIHC have championed solutions to the rental housing affordability crisis that would increase the supply of affordable rental housing and establish new rental assistance programs. However, the latest portrait of pinched renter households painted by Census data comes at the same time as historic levels of assistance for renters offered during the COVID-19 pandemic ended. By the end of 2023, more than 90% of states had closed their programs, which provided $46.5 billion in collective aid to keep people housed during the public health crisis.

Story editing by Carren Jao. Additional editing by Elisa Huang. Copy editing by Kristen Wegrzyn.