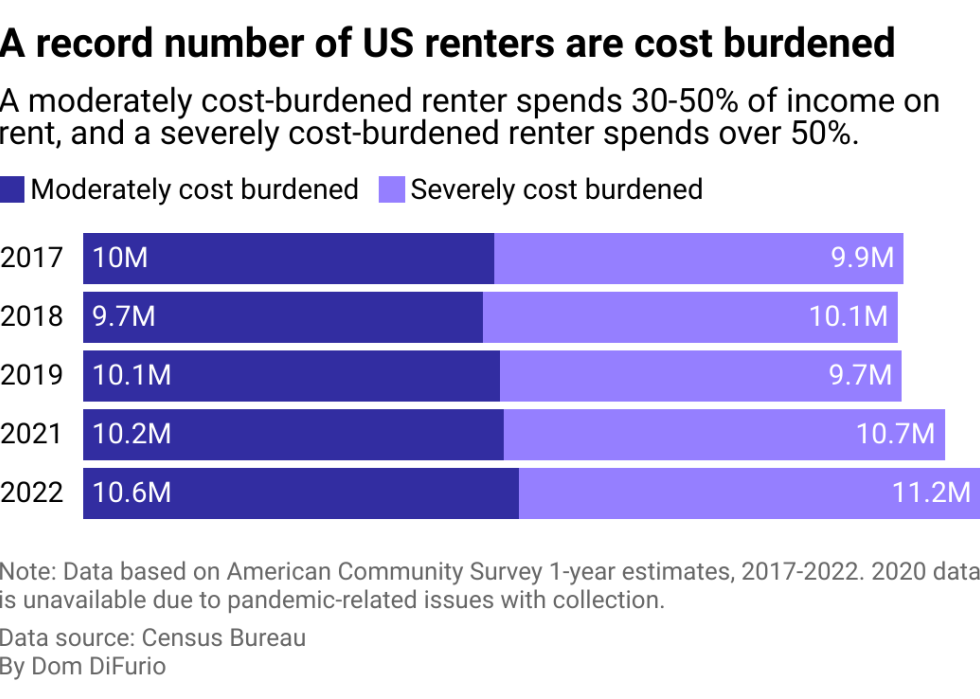

The number of cost-burdened renters has hit an all-time high

A record 21.8 million American renters were considered cost burdened in 2022, up 4% from the year before and representing about half of all American renters. Growth of cost-burdened renters began to grow quickly in 2021 as real estate values started to soar.

The journey to curb inflated housing costs with higher interest rates has thus far not tipped the country into a feared recession—but it's still brought pain for consumers. Americans are putting more expenses than ever on credit cards, which carry higher interest rates now than ever before. Rising interest rates also make it harder for the typical American who might want to purchase a home to afford it.

Cost-burdened renters are more likely to be economically vulnerable since they have no choice but to rent and have lower household incomes. Median renter household income in 2022 was $47,000, with about a third of renters reporting household incomes of less than $30,000. What's more, lower-income renters are often older, or over the age of 65, and tend to live alone. They're also more likely to belong to Black, Hispanic, and multiracial families. With longstanding racial discrimination across housing, education, and labor markets, Black heads of household have fewer housing options and a higher likelihood of bringing in less income than households of other races or ethnicities.

More than a third of renter households working 40-hour weeks are also cost burdened. These employees—with jobs in health care, education, sales, and construction—prove that full employment does not offer protection from unaffordable housing costs.

The growth of severely cost-burdened renters, or those spending more than 50% of their income on rent, is pushing consumers to live in inadequate or unsafe housing conditions and purchase fewer necessities like food and health care, Harvard's analysis of Bureau of Labor Statistics data found.

In its research, Harvard recommended reinvestment in aging housing stock and bolstering rental assistance for lower-income earners as higher interest rates are likely to persist, making it difficult for developers to turn a profit building anything besides higher-end housing.

Story editing by Nicole Caldwell. Copy editing by Tim Bruns.