With property values strong in 2023, many homeowners tapped home equity lines of credit, pushing total HELOC balances up 6.6%

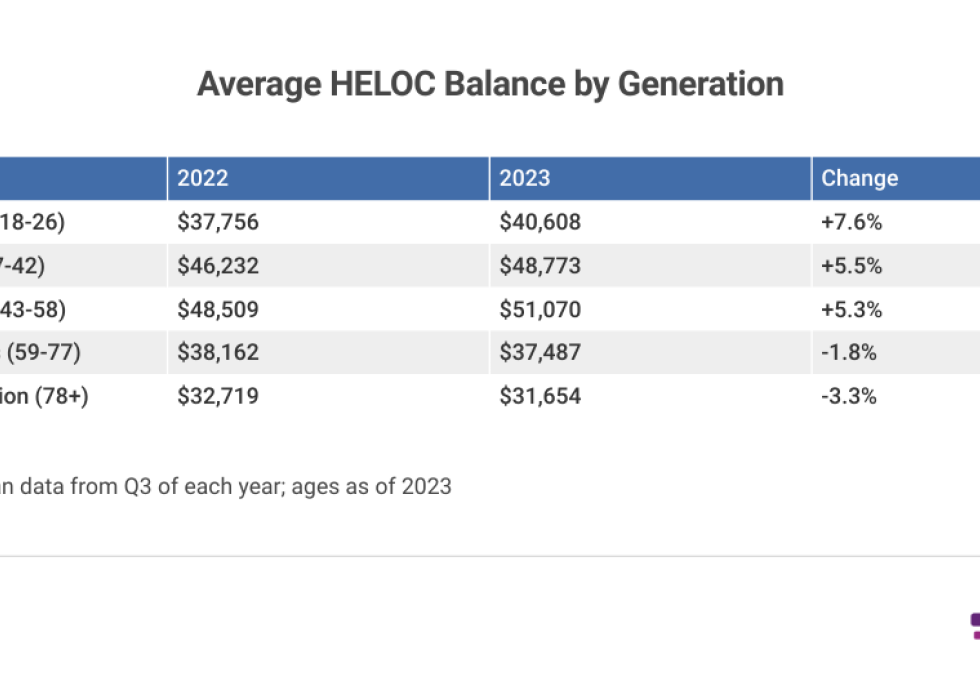

At first glance, it couldn't be more clear about which generations have been tapping home equity more. Homeowners born in 1965 or later have higher average balances than baby boomers or the Silent Generation, whose balances are lower than they were in 2022.

While household makeup explains much of the disparity in balances—younger homeowners who are building a family and updating their home to accommodate it versus older empty-nesters—there are other considerations. Reverse mortgages, for instance, are an alternative to HELOCs and other types of mortgage-based loans, but are only available to homeowners 62 or older who have paid off most or all of their mortgage.

While not all newer loans are for younger borrowers, there is some correlation between loan age and homeowner age.

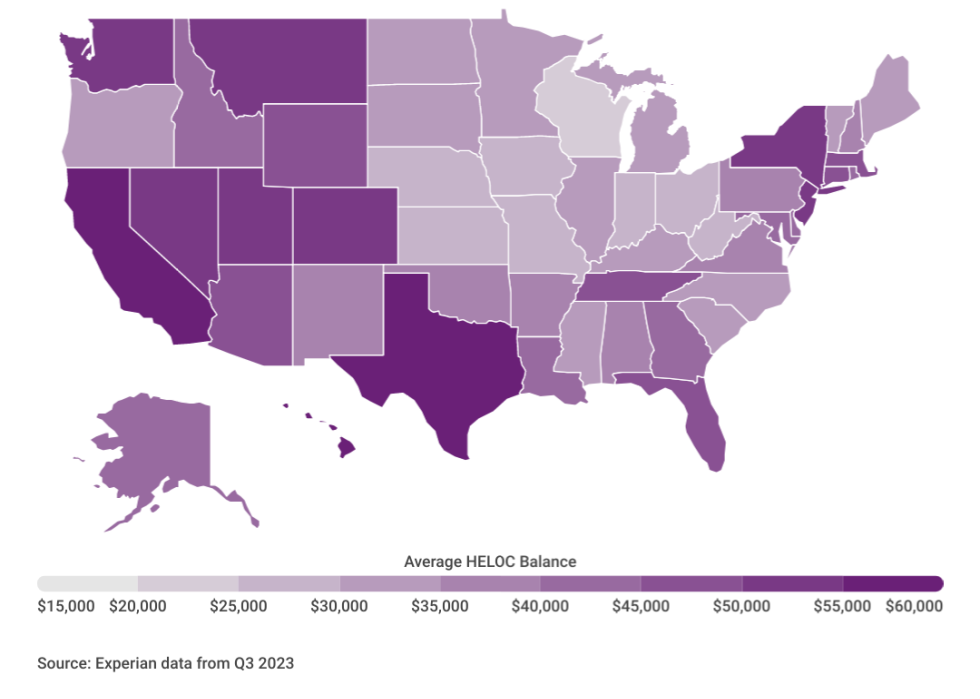

Average outstanding HELOC balances are higher in 45 states and Washington D.C., in 2023.

HELOC balances climbed in most states, with the highest in Hawaii (+13.7%), Colorado (+10.5%), South Dakota (+8.9%), South Carolina (+8.2%) and Tennessee (+8.1%).

Where balances increased the most, there's no apparent throughline: Sparsely populated South Dakota, a pair of Southern states and Hawaii have little in common other than sharply increasing HELOC balances. As for Colorado, homeowners there increased average balances by more than 10% for the second consecutive year. It's a testament to the tight housing market in the state: There are fewer homes to choose from and homeowners are increasingly turning to renovation instead of trading up.

The states where average HELOC balances declined were among the largest urban centers in the nation: California, Illinois and the states that include the New York metropolitan area (Connecticut, New York, and New Jersey) saw HELOC balances decline in an otherwise up-balance year.

HELOCs in 2024: Almost Ready for Prime Time?

With consumer demand for credit not slowing down so far in 2024, why aren't HELOC offers seen everywhere?

Mortgage lenders have also been investing heavily in streamlining the HELOC application process, such as using AI-powered property valuations and employment verification.

However, due to the larger loan amounts and the lien recording involved, borrowers may need to be a bit more patient than they would for a smaller-sized unsecured loan. In exchange for their patience, they'll likely receive a loan rate significantly lower than they would for an unsecured loan. Once a HELOC is issued, homeowners should be intentional about HELOC utilization even as home prices continue to appreciate at historic rates.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.