Where real estate taxes are highest in the US

Cities are ranked based on the highest percentage of median annual real estate taxes paid on owner-occupied homes with a mortgage relative to the median home value of such households.

- Peoria, Illinois

- Percent of home value as annual real estate taxes: 2.64%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $4,455

- Median value of owner-occupied homes with a mortgage: $168,900

- Median real estate taxes paid on homes without a mortgage: $2,315

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,476

- Aggregate real estate taxes paid in 2023: $135,405,200

- Rockford, Illinois

- Percent of home value as annual real estate taxes: 2.46%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $3,452

- Median value of owner-occupied homes with a mortgage: $140,300

- Median real estate taxes paid on homes without a mortgage: $2,868

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,216

- Aggregate real estate taxes paid in 2023: $128,214,000

- Waterbury, Connecticut

- Percent of home value as annual real estate taxes: 2.39%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $5,607

- Median value of owner-occupied homes with a mortgage: $234,400

- Median real estate taxes paid on homes without a mortgage: $4,892

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,776

- Aggregate real estate taxes paid in 2023: $106,040,300

- Syracuse, New York

- Percent of home value as annual real estate taxes: 2.36%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $3,254

- Median value of owner-occupied homes with a mortgage: $137,800

- Median real estate taxes paid on homes without a mortgage: $3,044

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,206

- Aggregate real estate taxes paid in 2023: $74,376,400

- Albany, New York

- Percent of home value as annual real estate taxes: 2.34%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $5,561

- Median value of owner-occupied homes with a mortgage: $237,700

- Median real estate taxes paid on homes without a mortgage: $3,920

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,744

- Aggregate real estate taxes paid in 2023: $96,373,000

- Paterson, New Jersey

- Percent of home value as annual real estate taxes: 2.31%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $10,000

- Median value of owner-occupied homes with a mortgage: $432,000

- Median real estate taxes paid on homes without a mortgage: $9,694

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,574

- Aggregate real estate taxes paid in 2023: $126,218,300

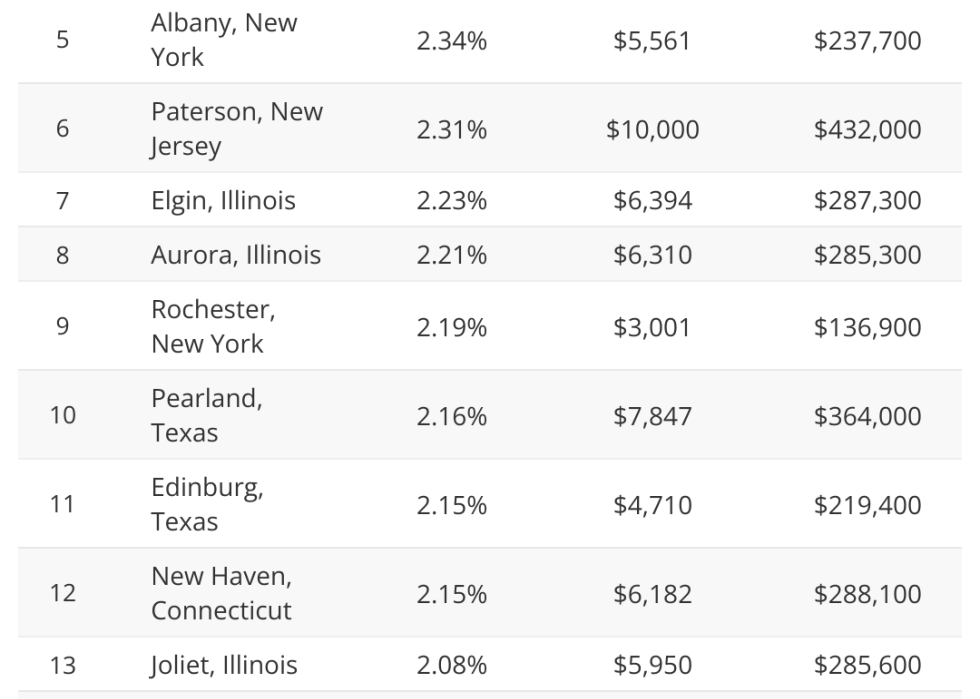

- Elgin, Illinois

- Percent of home value as annual real estate taxes: 2.23%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,394

- Median value of owner-occupied homes with a mortgage: $287,300

- Median real estate taxes paid on homes without a mortgage: $4,897

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,132

- Aggregate real estate taxes paid in 2023: $177,934,300

- Aurora, Illinois

- Percent of home value as annual real estate taxes: 2.21%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,310

- Median value of owner-occupied homes with a mortgage: $285,300

- Median real estate taxes paid on homes without a mortgage: $5,359

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,887

- Aggregate real estate taxes paid in 2023: $253,707,800

- Rochester, New York

- Percent of home value as annual real estate taxes: 2.19%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $3,001

- Median value of owner-occupied homes with a mortgage: $136,900

- Median real estate taxes paid on homes without a mortgage: $2,968

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,205

- Aggregate real estate taxes paid in 2023: $110,398,400

- Pearland, Texas

- Percent of home value as annual real estate taxes: 2.16%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $7,847

- Median value of owner-occupied homes with a mortgage: $364,000

- Median real estate taxes paid on homes without a mortgage: $5,555

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,515

- Aggregate real estate taxes paid in 2023: $247,198,700

Top 10 Cities With the Lowest Real Estate Taxes

Cities are ranked based on the lowest percentage of median annual real estate taxes paid on owner-occupied homes with a mortgage relative to the median home value of such households.

- Honolulu, Hawaii

- Percent of home value as annual real estate taxes: 0.28%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $2,346

- Median value of owner-occupied homes with a mortgage: $823,500

- Median real estate taxes paid on homes without a mortgage: $2,675

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,951

- Aggregate real estate taxes paid in 2023: $221,461,800

- Scottsdale, Arizona

- Percent of home value as annual real estate taxes: 0.32%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $2,773

- Median value of owner-occupied homes with a mortgage: $858,800

- Median real estate taxes paid on homes without a mortgage: $3,130

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,527

- Aggregate real estate taxes paid in 2023: $255,554,800

- San Tan Valley, Arizona

- Percent of home value as annual real estate taxes: 0.35%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $1,513

- Median value of owner-occupied homes with a mortgage: $427,800

- Median real estate taxes paid on homes without a mortgage: $1,725

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,791

- Aggregate real estate taxes paid in 2023: $52,205,300

- Mesa, Arizona

- Percent of home value as annual real estate taxes: 0.35%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $1,641

- Median value of owner-occupied homes with a mortgage: $462,400

- Median real estate taxes paid on homes without a mortgage: $1,302

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,826

- Aggregate real estate taxes paid in 2023: $267,814,200

- Sunrise Manor, Nevada

- Percent of home value as annual real estate taxes: 0.36%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $1,248

- Median value of owner-occupied homes with a mortgage: $344,900

- Median real estate taxes paid on homes without a mortgage: $848

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,543

- Aggregate real estate taxes paid in 2023: $45,230,500

- Surprise, Arizona

- Percent of home value as annual real estate taxes: 0.37%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $1,668

- Median value of owner-occupied homes with a mortgage: $448,800

- Median real estate taxes paid on homes without a mortgage: $1,904

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,789

- Aggregate real estate taxes paid in 2023: $93,221,600

- Paradise, Nevada

- Percent of home value as annual real estate taxes: 0.39%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $1,599

- Median value of owner-occupied homes with a mortgage: $405,900

- Median real estate taxes paid on homes without a mortgage: $1,442

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,783

- Aggregate real estate taxes paid in 2023: $54,970,500

- Montgomery, Alabama

- Percent of home value as annual real estate taxes: 0.40%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $654

- Median value of owner-occupied homes with a mortgage: $164,700

- Median real estate taxes paid on homes without a mortgage: $431

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,208

- Aggregate real estate taxes paid in 2023: $37,985,500

- Gilbert, Arizona

- Percent of home value as annual real estate taxes: 0.40%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $2,467

- Median value of owner-occupied homes with a mortgage: $615,300

- Median real estate taxes paid on homes without a mortgage: $2,507

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,100

- Aggregate real estate taxes paid in 2023: $181,693,500

- Chandler, Arizona

- Percent of home value as annual real estate taxes: 0.40%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $2,221

- Median value of owner-occupied homes with a mortgage: $552,600

- Median real estate taxes paid on homes without a mortgage: $2,118

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,922

- Aggregate real estate taxes paid in 2023: $183,115,300

Top 10 Cities With the Highest Aggregate Residential Real Estate Taxes Collected

- New York, New York

- Aggregate real estate taxes paid in 2023: $7,457,402,200

- Percent of home value as annual real estate taxes: 0.81%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,228

- Median value of owner-occupied homes with a mortgage: $765,500

- Median real estate taxes paid on homes without a mortgage: $6,454

- Median monthly housing costs for owner-occupied homes with a mortgage: $3,087

- Los Angeles, California

- Aggregate real estate taxes paid in 2023: $4,070,373,600

- Percent of home value as annual real estate taxes: 0.72%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,702

- Median value of owner-occupied homes with a mortgage: $935,000

- Median real estate taxes paid on homes without a mortgage: $4,184

- Median monthly housing costs for owner-occupied homes with a mortgage: $3,394

- Chicago, Illinois

- Aggregate real estate taxes paid in 2023: $3,201,888,000

- Percent of home value as annual real estate taxes: 1.52%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $5,146

- Median value of owner-occupied homes with a mortgage: $337,600

- Median real estate taxes paid on homes without a mortgage: $4,000

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,235

- Houston, Texas

- Aggregate real estate taxes paid in 2023: $2,307,142,700

- Percent of home value as annual real estate taxes: 1.70%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $5,728

- Median value of owner-occupied homes with a mortgage: $336,700

- Median real estate taxes paid on homes without a mortgage: $2,989

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,219

- Austin, Texas

- Aggregate real estate taxes paid in 2023: $1,935,298,100

- Percent of home value as annual real estate taxes: 1.43%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $8,742

- Median value of owner-occupied homes with a mortgage: $610,100

- Median real estate taxes paid on homes without a mortgage: $7,293

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,768

- San Diego, California

- Aggregate real estate taxes paid in 2023: $1,873,287,900

- Percent of home value as annual real estate taxes: 0.70%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,583

- Median value of owner-occupied homes with a mortgage: $944,200

- Median real estate taxes paid on homes without a mortgage: $4,537

- Median monthly housing costs for owner-occupied homes with a mortgage: $3,204

- San Jose, California

- Aggregate real estate taxes paid in 2023: $1,837,758,600

- Percent of home value as annual real estate taxes: 0.79%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $10,000

- Median value of owner-occupied homes with a mortgage: $1,258,800

- Median real estate taxes paid on homes without a mortgage: $6,224

- Median monthly housing costs for owner-occupied homes with a mortgage: $3,855

- Dallas, Texas

- Aggregate real estate taxes paid in 2023: $1,592,898,300

- Percent of home value as annual real estate taxes: 1.69%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,727

- Median value of owner-occupied homes with a mortgage: $398,800

- Median real estate taxes paid on homes without a mortgage: $3,435

- Median monthly housing costs for owner-occupied homes with a mortgage: $2,381

- San Antonio, Texas

- Aggregate real estate taxes paid in 2023: $1,271,058,300

- Percent of home value as annual real estate taxes: 1.77%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $4,944

- Median value of owner-occupied homes with a mortgage: $279,400

- Median real estate taxes paid on homes without a mortgage: $2,981

- Median monthly housing costs for owner-occupied homes with a mortgage: $1,784

- Seattle, Washington

- Aggregate real estate taxes paid in 2023: $1,234,890,600

- Percent of home value as annual real estate taxes: 0.77%

- Median real estate taxes paid on owner-occupied homes with a mortgage: $6,992

- Median value of owner-occupied homes with a mortgage: $910,300

- Median real estate taxes paid on homes without a mortgage: $6,984

- Median monthly housing costs for owner-occupied homes with a mortgage: $3,369

Data and Methodology

SmartAsset examined data from the Census Bureau's 1-Year American Community Survey for 2023. The study includes 342 cities with greater than 100,000 in population. Specifically, cities are ranked by the median real estate taxes paid (by homeowners with a mortgage) as a proportion of the median annual housing payments. Any amounts of $10,000 even may actually be higher than $10,000.