These 25 counties have the most debt in collections in the US

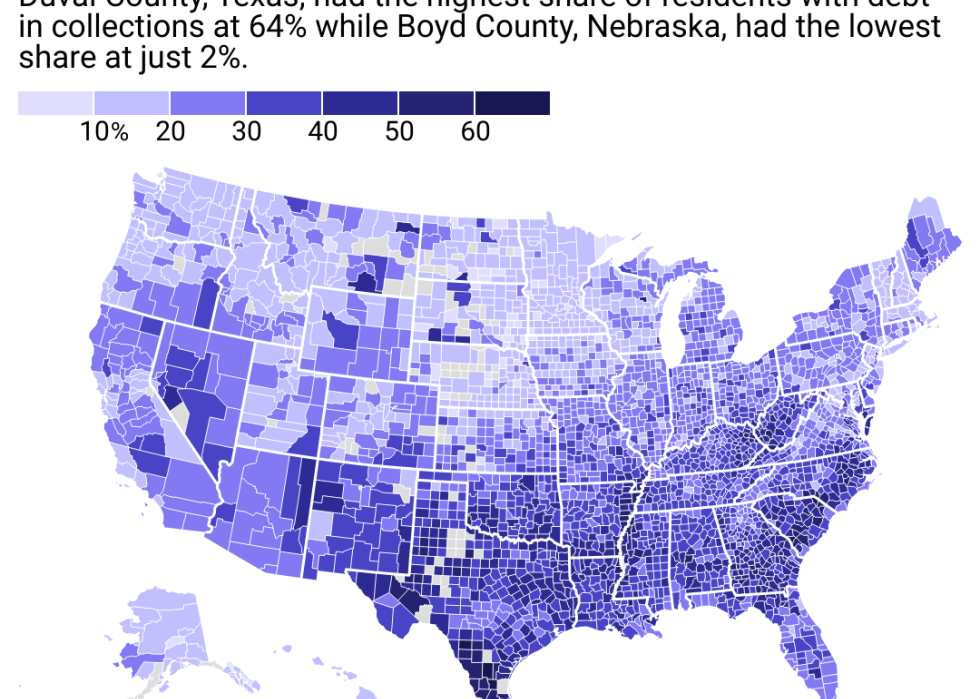

Plotting the debt data on a map reveals some striking geographic trends. Counties in the South and the Appalachian mountains tended to have very high delinquency rates. In contrast, counties in the Great Plains region north of Oklahoma, the northwest, and New England were likelier to have far lower debt delinquency rates.

Duval County, Texas, in the southern part of the state, had the highest delinquency rate—64% of its adult residents had defaulted on their debt payments in February 2022. Meanwhile, only 2% of Boyd County, Nebraska, residents had debt in collections.

Research, including a 2019 study published by the American Journal of Public Health, has found medical debt is a major contributor to personal bankruptcies. The problem is especially acute for the uninsured, who can face far bigger medical bills. Many states, particularly in the South, chose to not expand Medicaid, health coverage for low-income Americans, after the Affordable Care Act passed. Texas, for instance, has the highest share of people without health insurance at 16.6%.

Debt delinquencies for young adults tended to be rarer. The Urban Institute estimates that only 20% of Americans aged 18 to 24 had debt in collections in February 2022. This, however, could change soon. In June 2023, Congress announced it would end the student loan pause, meaning from Sept. 1 last year, 28 million predominantly young borrowers have had or will have to start making interest payments.

More worryingly, the share of credit card bills becoming at least 90 days late hit 5.8% in the third quarter of 2023, its highest level since 2011. The Urban Institute's data could look much less rosy in a year's time.

- 53.7% of residents have debt in collections

-- owing a median amount of $1,639.50

- 43.82% of residents have medical debt in collections

- 11.32% of residents have missed student loan debt in default

- 8.42% of residents are at least 60 days delinquent on their car/retail loans

- 7.49% of residents are delinquent on their credit card payments

- 53.9% of residents have debt in collections

-- owing a median amount of $1,540.50

- 43.84% of residents have medical debt in collections

- 14.58% of residents have missed student loan debt in default

- 7.02% of residents are at least 60 days delinquent on their car/retail loans

- 6.29% of residents are delinquent on their credit card payments

- 53.9% of residents have debt in collections

-- owing a median amount of $1,517.50

- 23.25% of residents have medical debt in collections

- 12.86% of residents have missed student loan debt in default

- 9.81% of residents are at least 60 days delinquent on their car/retail loans

- 3.65% of residents are delinquent on their credit card payments

- 54.1% of residents have debt in collections

-- owing a median amount of $1,719.50

- 27.67% of residents have medical debt in collections

- Data on student loans is unavailable

- 5.36% of residents are at least 60 days delinquent on their car/retail loans

- Data on credit card debt are unavailable

- 54.2% of residents have debt in collections

-- owing a median amount of $2,109

- 37.3% of residents have medical debt in collections

- Data on student loans is unavailable

- 10.3% of residents are at least 60 days delinquent on their car/retail loans

- 5.14% of residents are delinquent on their credit card payments

- 54.2% of residents have debt in collections

-- owing a median amount of $1,795

- 26.14% of residents have medical debt in collections

- Data on student loans is unavailable

- 12.5% of residents are at least 60 days delinquent on their car/retail loans

- 4.29% of residents are delinquent on their credit card payments

- 54.4% of residents have debt in collections

-- owing a median amount of $2,020.50

- 30.4% of residents have medical debt in collections

- Data on student loans is unavailable

- Data on car/retail loans are unavailable

- 7.69% of residents are delinquent on their credit card payments

- 54.4% of residents have debt in collections

-- owing a median amount of $2,082.50

- 25.44% of residents have medical debt in collections

- 22.06% of residents have missed student loan debt in default

- 10.2% of residents are at least 60 days delinquent on their car/retail loans

- 7.61% of residents are delinquent on their credit card payments

- 54.6% of residents have debt in collections

-- owing a median amount of $1,945.50

- 32.21% of residents have medical debt in collections

- 24% of residents have missed student loan debt in default

- 11.19% of residents are at least 60 days delinquent on their car/retail loans

- 6.52% of residents are delinquent on their credit card payments

- 54.6% of residents have debt in collections

-- owing a median amount of $1,605

- 32.08% of residents have medical debt in collections

- 13.53% of residents have missed student loan debt in default

- 10.95% of residents are at least 60 days delinquent on their car/retail loans

- 6.93% of residents are delinquent on their credit card payments

- 55.1% of residents have debt in collections

-- owing a median amount of $2,174.50

- 41.65% of residents have medical debt in collections

- Data on student loans is unavailable

- 7.77% of residents are at least 60 days delinquent on their car/retail loans

- 6.8% of residents are delinquent on their credit card payments

- 55.5% of residents have debt in collections

-- owing a median amount of $1,671

- 37.07% of residents have medical debt in collections

- 13.87% of residents have missed student loan debt in default

- 10.45% of residents are at least 60 days delinquent on their car/retail loans

- 5.48% of residents are delinquent on their credit card payments

- 55.7% of residents have debt in collections

-- owing a median amount of $1,910

- 42.76% of residents have medical debt in collections

- 9.76% of residents have missed student loan debt in default

- 7.12% of residents are at least 60 days delinquent on their car/retail loans

- 8.25% of residents are delinquent on their credit card payments

- 56% of residents have debt in collections

-- owing a median amount of $1,340

- 35.6% of residents have medical debt in collections

- Data on student loans is unavailable

- 9.76% of residents are at least 60 days delinquent on their car/retail loans

- 7.27% of residents are delinquent on their credit card payments

- 56.3% of residents have debt in collections

-- owing a median amount of $1,511

- 31.74% of residents have medical debt in collections

- 13.56% of residents have missed student loan debt in default

- 5.96% of residents are at least 60 days delinquent on their car/retail loans

- 8.2% of residents are delinquent on their credit card payments

- 57.6% of residents have debt in collections

-- owing a median amount of $1,884

- 31.75% of residents have medical debt in collections

- 13.41% of residents have missed student loan debt in default

- 10.43% of residents are at least 60 days delinquent on their car/retail loans

- 8.5% of residents are delinquent on their credit card payments

- 57.7% of residents have debt in collections

-- owing a median amount of $2,742

- 33% of residents have medical debt in collections

- 8.38% of residents have missed student loan debt in default

- 8.94% of residents are at least 60 days delinquent on their car/retail loans

- 6.77% of residents are delinquent on their credit card payments

- 57.7% of residents have debt in collections

-- owing a median amount of $2,708

- 29.38% of residents have medical debt in collections

- 27.78% of residents have missed student loan debt in default

- 12.06% of residents are at least 60 days delinquent on their car/retail loans

- 11.73% of residents are delinquent on their credit card payments

- 58.8% of residents have debt in collections

-- owing a median amount of $2,173

- 26.56% of residents have medical debt in collections

- Data on student loans is unavailable

- 9.15% of residents are at least 60 days delinquent on their car/retail loans

- 9.3% of residents are delinquent on their credit card payments

- 59.9% of residents have debt in collections

-- owing a median amount of $2,489

- 35.21% of residents have medical debt in collections

- Data on student loans is unavailable

- 10% of residents are at least 60 days delinquent on their car/retail loans

- Data on credit card debt are unavailable

- 60.3% of residents have debt in collections

-- owing a median amount of $1,434.50

- 18.03% of residents have medical debt in collections

- Data on student loans is unavailable

- 13.82% of residents are at least 60 days delinquent on their car/retail loans

- 5.32% of residents are delinquent on their credit card payments

- 60.9% of residents have debt in collections

-- owing a median amount of $1,784

- 37.14% of residents have medical debt in collections

- 11.4% of residents have missed student loan debt in default

- 15.24% of residents are at least 60 days delinquent on their car/retail loans

- 6.51% of residents are delinquent on their credit card payments

- 61.2% of residents have debt in collections

-- owing a median amount of $2,441.50

- 32.33% of residents have medical debt in collections

- Data on student loans is unavailable

- 13.33% of residents are at least 60 days delinquent on their car/retail loans

- 3.8% of residents are delinquent on their credit card payments

- 62.5% of residents have debt in collections

-- owing a median amount of $2,606

- 29.03% of residents have medical debt in collections

- Data on student loans is unavailable

- 8.99% of residents are at least 60 days delinquent on their car/retail loans

- 8.11% of residents are delinquent on their credit card payments

- 64.1% of residents have debt in collections

-- owing a median amount of $2,334

- 33.33% of residents have medical debt in collections

- Data on student loans is unavailable

- 11.7% of residents are at least 60 days delinquent on their car/retail loans

- 2.44% of residents are delinquent on their credit card payments

Story editing by Ashleigh Graf. Copy editing by Kristen Wegrzyn. Photo selection by Clarese Moller.